ARN’s parent company HT&E has “emerged as a stronger business by strengthening core radio operations and building momentum into digital audio growth,” in a tough year for the company, with all its markets “impacted, as the pandemic hit all sectors across the advertising market.”

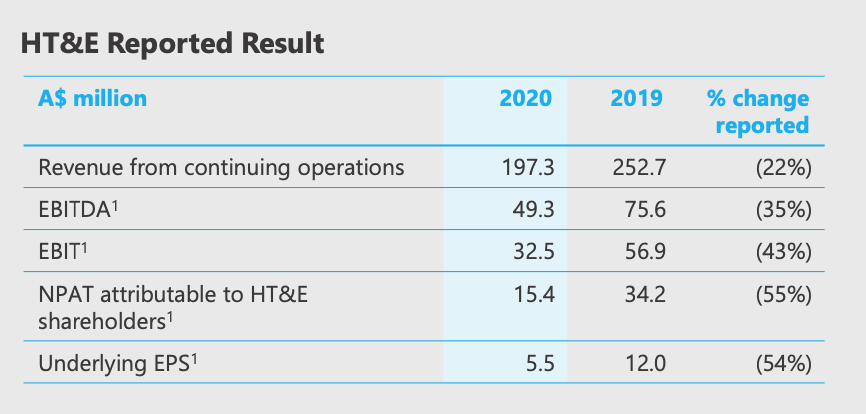

The company’s annual financial results, released today show revenue from continuing operations at $197 million, down 22% from $252 million in HT&E’s previous reporting year.

Profit (EBITDA) was $49.3 m, down from $75.6 m. A final dividend was not paid.

- ARN #1 metropolitan network in Australia for 9th consecutive survey

- Growth in total listening across the year despite disruption to daily routines

- Record audience reach of 5.3 million listeners a week

- ARN winning commercial share – exceeded market each quarter in 2020

- Momentum building in digital audio transformation

- +19% growth in iHeartRadio registered users to 1.9 million

- #1 podcast publisher in Australia with over 16 million downloads a month

- Balance sheet strength maintained – net cash reserves $112 million

- $13 million one-off savings delivered

- Eligible for the initial round of JobKeeper, receiving $10.3 million

- Strategic minority stake acquired in oOh!media

- HT&E appointed Macquarie Capital to explore liquidity options for Soprano stake

During the year ARN saw strong growth in digital listening with +19% increase in iHeartRadio registered users, and also launched the iHeartRadio Podcast Network which is now the #1 podcast publisher in the country with over 16 million downloads a month.

This result was achieved in a year where the global pandemic changed consumer behaviour, disrupted business models overnight, created significant advertiser uncertainty and resulted in widespread falls in global and local advertising revenues. The company’s main money earner, Australian Radio Network, grew total listening across COVID-19, with ARN stations now reaching 5.3 million people weekly from breakfast to drive. Streaming of ARN radio stations experienced an increase of 14% in total listening. ARN is the “number one podcast publisher in the country after iHeartRadio Podcast Network Australia launched in February 2020.”

Podcast downloads increased by 124%.

The company received the government’s covid Jobkeeper grant in the first half of 2020, but recovered sufficiently in the second half of the year so as not to be eligible for the subsidy.

Managing Director Ciaran Davis said:

“Despite the extraordinary disruption to our business due to the pandemic, ARN maintained its position as the #1 metropolitan network in Australia, and continued to take commercial market share. We are building momentum in our digital audio transformation as extraordinary growth of digital listening saw a 14% growth in iHeartRadio app downlands, and a 19% growth in registered users to 1.9m.

“What we achieved in 2020 demonstrates HT&E’s leadership in the Australian audio market. In a year that has rewritten history, Australian audiences have made ARN and iHeartRadio podcast brands the number one choice for audio content, delivering consistency and certainty for our commercial clients. I am confident that the momentum that we have built will continue in 2021 as we focus on creating the leading audio entertainment business in Australia.

“Coming out of the pandemic we are in an excellent position to drive shareholder value. We have protected earnings and cash reserves providing a very strong balance sheet and maximum optionality regarding our growth opportunities.”

Executive pay has been frozen as part of pandemic cost control measures, with executives forgoing their 2020 incentive payments. Davis has a total package of $1.197 million, down from 2019’s $1.717 million.

HT&E Chairman Hamish McLennan said:

“HT&E navigated the period well and has maintained its strategic focus during the year… ARN remains the best performing audio company in Australia, both commercially and in ratings, delivering advertisers integrated, unique and engaging content from some of the world’s best talent across radio, music streaming and podcasting.

“HT&E’s investment in oOh!media is already delivering value for shareholders. Our investment in Soprano has the potential to provide significant value beyond current book value and is non-core to the Company’s strategy. We have appointed Macquarie Capital to explore options to maximise our 25% shareholding. Cost control measures were taken early, with $13.0 million in one off savings in 2020.

“The Company was eligible for the initial round of JobKeeper, receiving $10.3 million. The role of JobKeeper was critical in supporting our employees and maintaining momentum through the June quarter, where revenues were back over 46% on the prior corresponding period, and we have been able to steadily build from there. Our response to COVID-19 was such that the Company did not qualify for JobKeeper in the September quarter.

“HT&E remains well capitalised, however the Board took the decision not to declare a final dividend, recognising the level of inherent economic uncertainty attributable to the ongoing COVID-19 pandemic. We remain committed to reinstating our dividend policy in 2021 if market conditions and performance allows.

“The Company remains confident with regard to its position in the ATO Branch matter and are prepared to pursue the matter fully through litigation.”

Subscribe to the radioinfo podcast on these platforms: Acast, Apple iTunes Podcasts, Podtail, Spotify, Google Podcasts, TuneIn, or wherever you get your podcasts.