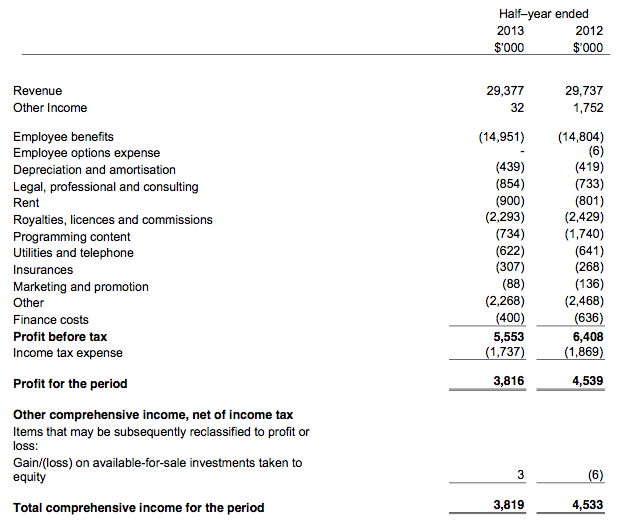

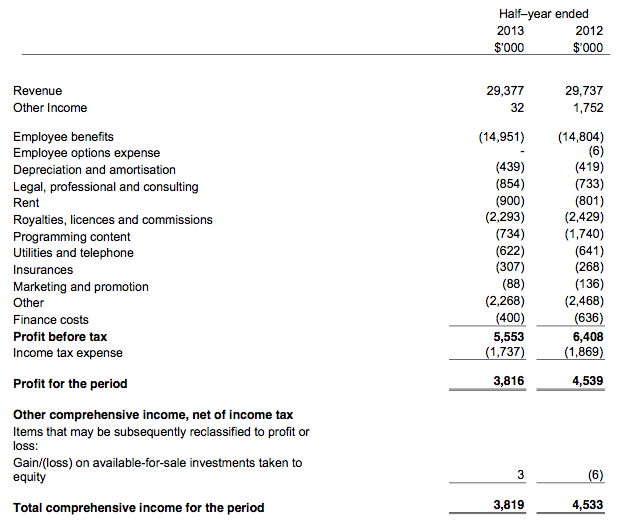

Macquarie Radio Network is another radio company reporting its financial results this week. MRS’s financials for the period ending 31 December 2013 show a drop in revenue of 7% over the previous corresponding period, to $29.4 million.

The company’s Sydney radio market revenue increased by 2.6% while ratings share decreased slightly from 23.5% to 22.8%. 2GB remains Sydney’s top station and breakfast star Alan Jones has just recently returned to air after an extended Christmas break for treatment of a persisten back injury.

In line with Stock exchange reporting requirements, MRN’s Net Profit After Tax (NPAT) decreased by 16% on pcp to $3.8 million. Reported EBITDA decreased by 14% on pcp to $6.4 million.

After removing abnormal items from teh balance sheet, MRN reported an underlying EBITDA increase of 10% over the previous corresponding period, to $6.4 million. Underlying NPAT increased by 31% on pcp to $3.8 million.

An interim dividend of 5 cents per share, fully franked, was declared, in line with the prior year and equal to the highest interim dividend paid by MRN.

MRN Executive Chairman

Russell Tate commented that the underlying performance of MRN for the 2014 half year was in line with guidance provided in November. MRN was not able to run the regional stations it bought from Smart Radio Network successfully, admitting the network has become a drain on profits:

“We expect that the full year underlying EBITDA will be more than 5% ahead of the prior year. Reported EBITDA levels for the full year are expected to be 15-20% below the prior year largely due to the absence of one-off net royalty revenue and the reversal of the provision in relation to the Smart Radio Network in the prior year,” he said.

MRN’s share price has nearly doubled over the past 12 months from a low of 64 cents, going as high as $1.55. The share price currently sits at $1.18.

For the company’s full financial report, click here.