Bob Peters reveals the big winners and losers in his in-depth analysis. Fiscal 2012/13 was another good ratings year for metropolitan FM radio, but also another disappointing one for metro AM broadcasting.

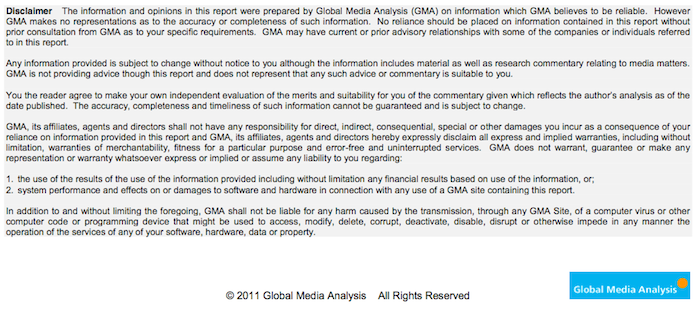

Total metro FM radio listening (to both commercial and ABC stations) during the eight ratings surveys to June 2013 increased on both an average and cumulative 10+ audience basis by 3.2% and 3.4% respectively.

In contrast, metro AM radio listening over the same period declined with average and cumulative 10+ audiences falling by 4.3% and 2.7% respectively.

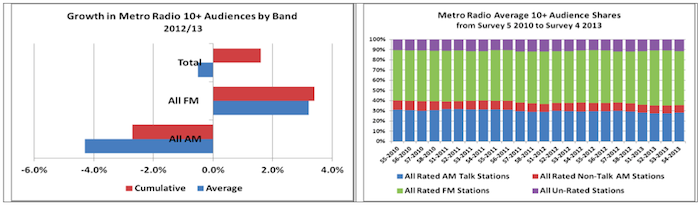

For the second straight fiscal year Melbourne was the nation’s largest metro radio market in terms of average 10+ audiences with a 32.6% share, however Sydney maintained its traditional top position in terms cumulative 10+ audiences with a comparable 32.6% share.

DMG Radio Australia (DMG) recorded the largest increases in both average and cumulative 10+ audiences following the very successful introduction of the smoothfm format to its second FM stations in Sydney and Melbourne and also as result of audience growth at all five of its Nova-branded stations, particular those in Perth and Brisbane.

DMG’s audience gains last year resulted in it becoming the second largest commercial metro radio group in terms of both average and cumulative 10+ audiences.

Average and Cumulative Audience Trends

In 2012/13, total metro average 10+ audiences declined slightly by 0.5%, as a result of a 3.2% rise in average FM audiences, being more than offset by a larger 4.3% fall in average AM audiences.

However, total metro cumulative 10+ audiences over the same period increased by 1.6%, as a 3.4% rise in FM cumulative audiences exceeded a 2.7% decline in cumulative AM listening.

In other words, while there were slightly fewer listeners to metro radio last year, there was nevertheless an increase in the total amount of time spent listening to metro radio.

Analysis of Individual Metro Markets

Audience growth was particularly strong in Perth last year. Average 10+ audiences increased by 3.7% in Perth, by 0.4% in Brisbane and by 0.1% in Melbourne during 2012/13. However, that growth was offset by declines in average 10+ audiences of 2.6% in Sydney and 2.3% in Adelaide.

In contrast, all five metro markets enjoyed increases in cumulative 10+ audiences, with Perth generating the highest growth (+3.7%) and Adelaide the lowest (+0.9%).

For the second straight year, Melbourne recorded the largest average 10+ audience with a 32.6% share of the metro total, while Sydney followed with a 31.6% share.

However, in terms of cumulative 10+ audiences, the rankings were reversed with Sydney on top with a 32.6% share and Melbourne in second place with a 31.6% share.

Meanwhile, Perth continued to challenge Brisbane for the third position in terms of average 10+ audience shares (13.3% for Perth versus 13.6% for Brisbane). But Brisbane clearly remained the third largest metro market in terms of cumulative 10+ audiences, with a 14.5% share versus Perth’s lesser 12.6% share.

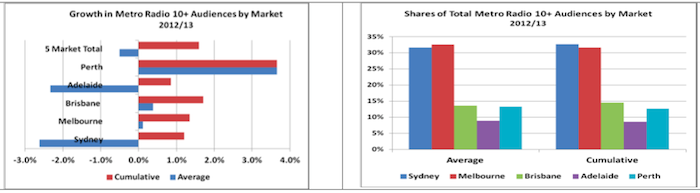

Metro Radio Group Performance

Amongst the six largest metro radio groups (including the ABC), DMG was the big winner in terms of audience growth in 2012/13. Last year it increased its average 10+ audience by 10.4% and its cumulative 10+ audience by 11.6%.

Amongst the six largest metro radio groups (including the ABC), DMG was the big winner in terms of audience growth in 2012/13. Last year it increased its average 10+ audience by 10.4% and its cumulative 10+ audience by 11.6%.

The highly successful introduction of the smoothfm format at DMG’s second FM stations in Sydney and Melbourne resulted in a remarkable 43.2% increase in average 10+ audiences for those two stations in 2012/13.

DMG also increased average 10+ audiences at each of its five Nova-branded stations last year, with Perth and Brisbane enjoying the biggest improvements, leading to an overall 6.0% rise for the five Nova stations.

Last year, the non-commercial Australian Broadcasting Corporation (ABC) and the commercial Australian Radio Network (ARN) also experienced modest increases in average 10+ audiences of 1.9% and 1.3% respectively.

Amongst the ABC’s five metro networks, three increased their average 10+ audiences (triple J up 7.9%; Classic FM up 2.4% & Local up 1.4%), while RN (down 3.6%) and NewsRadio (down 8.3%) each shed listeners last year.

In aggregate, the ABC’s three AM (Local, RN & NewsRadio) and two FM (triple J & Classic FM) metro networks performed better than their commercial counterparts and consequently the ABC’s shares of all rated AM, FM and total average and cumulative 10+ audiences each increased modestly in 2012/13.

The two major commercial metro AM broadcasters, Fairfax Media (FXJ) and Macquarie Radio Network (MRN), suffered the largest average 10+ audience reductions last year, with falls of 6.6% and 5.3% respectively.

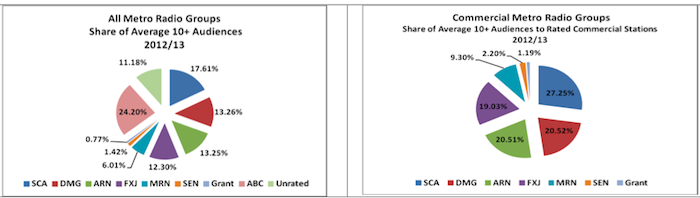

Dominant commercial FM broadcaster Southern Cross Austereo (SCA) also experienced a 4.2% fall in its average 10+ audience as its Today and Triple M networks registered listener declines of 1.8% and 5.9% respectively. Nevertheless, SCA remained the largest commercial metro radio group with a 27.3% share of average 10+ audiences to all rated commercial stations in 2012/13.

DMG’s increases in average 10+ audiences last year enabled it to displace both ARN and FXJ as the second largest commercial metro radio group based on average audiences with a 20.52% share of commercial average 10+ audiences, whereas in 2011/12 it was ranked fourth with an 18.45% share.

Top and Bottom Ten Stations Based on Average Audience Change

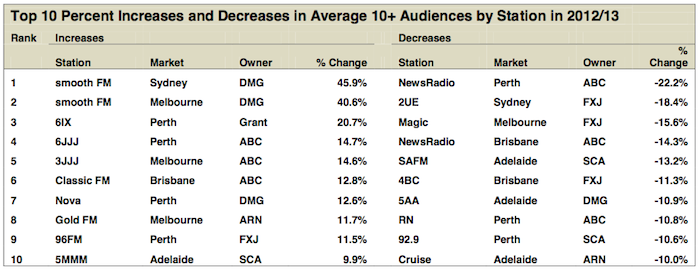

Amongst the 62 individually rated metro radio stations, the top ten and bottom ten in terms of growth in average 10+ audiences during 2012/13 are listed above and the following observations are noteworthy:

The audience growth amongst the top ten stations ranged between 45.9% and 9.9%;

The audience growth amongst the bottom ten stations ranged between -22.2% and -10.0%;

FM stations accounted nine of the ten fastest growing metro stations;

AM stations accounted for eight of the ten worst performers;

DMG’s two smoothfm stations generated the highest audience growth;

The ABC’s NewsRadio station in Perth was the worst performer;

Four of the ten fastest growing stations were in Perth and three were in Melbourne;

Perth and Adelaide each had three of the ten worst performing stations;

DMG and the ABC each had three of the best performing stations; and

The ABC and FXJ each had three of the poorest performing stations.

About the Author

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Prior to establishing GMA in early 2001, Bob was a Director of Corporate Finance with ANZ Investment Bank and prior to that Capel Court Investment Bank.

In both his current and previous positions, Bob provides advice to corporate clients in relation to: takeovers & mergers; asset acquisitions & disposals; debt and equity fund-raisings; financial planning & restructuring; business & asset valuations; financial & economic feasibility studies; and the formulation of business strategies.

Bob holds a Bachelor in Economics degree from the Wharton School of Finance & Commerce at the University of Pennsylvania; a Master of Business Administration from The City University in London; and a Master of Economics degree from LaTrobe University in Melbourne.