Several studies conducted over the past few years have shown that listener habits are evolving beyond traditional radio to new personalised streaming radio services. Radio streaming service, Spotify, decided to look deeper into their own listeners and how these new habits may be increasing radios reach.

Between May and June this year Spotify commissioned research to quantify the reach and quality of their Spotify Free users in 10 countries across Europe. Conducted by TNS, the study surveyed over 20,000 respondents and is the first of its kind to have been measured directly alongside commercial radio in each region.

The study found what many have suspected, people are listening to radio in new much more mobile ways. They listen on the go and across devices, taking full advantage of all mobile and connected platforms. Also people listened to the radio streaming service throughout the day, not just during their morning drive.

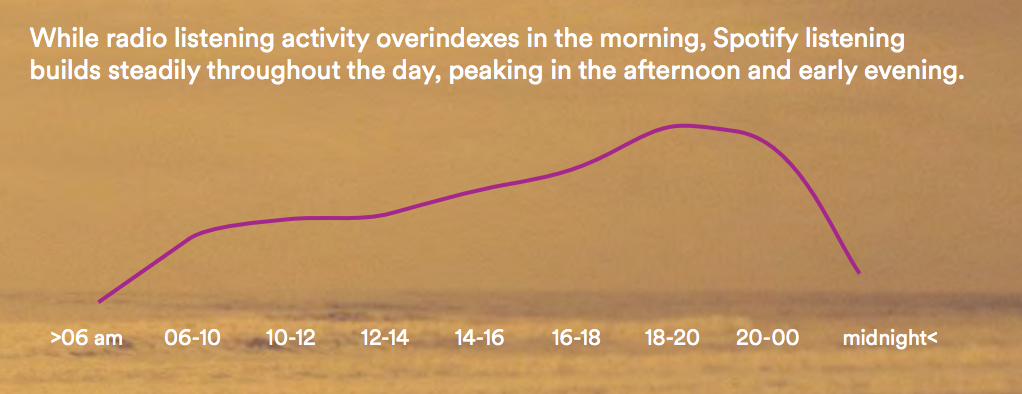

While commercial radio listening activity peaks during the morning, the Spotify Free service listening continues to build steadily throughout the day, peaking in the afternoon and early evening.

The research shows that Spotify Free and other streaming services can reach audience segments that are difficult to reach through traditional commercial radio, due to the shifting audio landscape in which streaming media is rapidly growing in terms of audience penetration and time spent listening.

Spotify VP of EMEA Sales, Jonathan Forster said:

“We hope the results help demystify today’s audio consumer and shed more light on how digital and broadcast platforms complement one another. The audio advertising industry continues to grow. New content distribution channels will enable the audio medium and audio advertising to flourish. It all starts with knowing where, when and how your audience listens.”

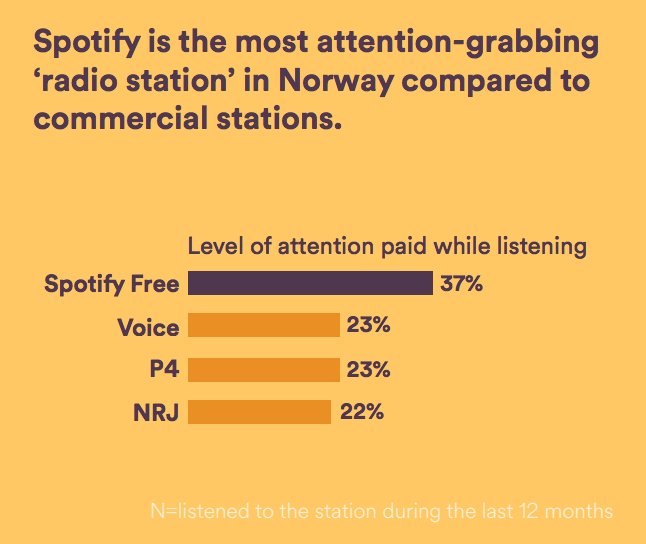

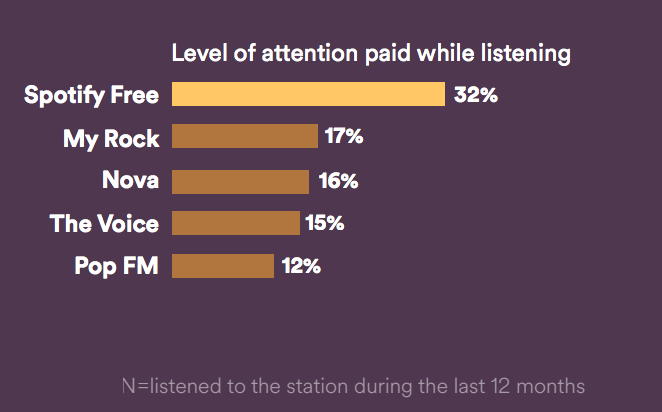

The study showed that people are more likely to pay attention while listening on the Spotify Free service than they do to commercial radio.

It also revealed that Spotify provided incremental reach to every radio station on a weekly basis, with an average of 10% across Europe.

Across the 15-34 age group, Spotify adds a minimum of 14% incremental reach to UK commercial radio stations, up to a maximum of 21%.

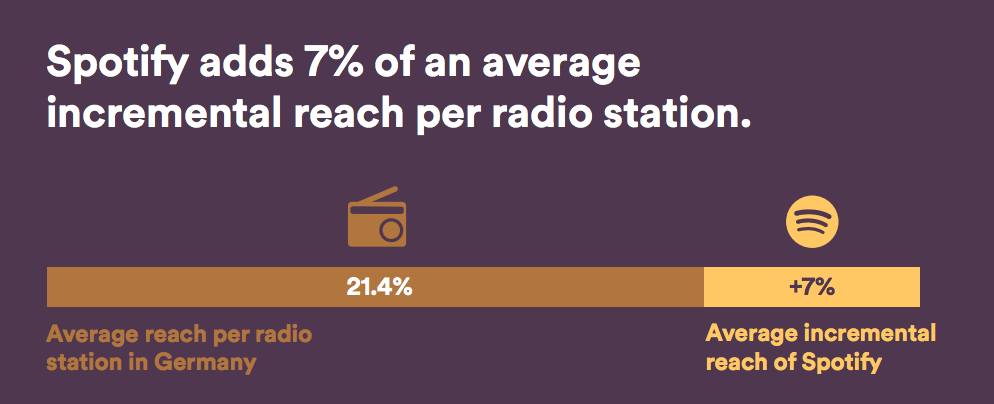

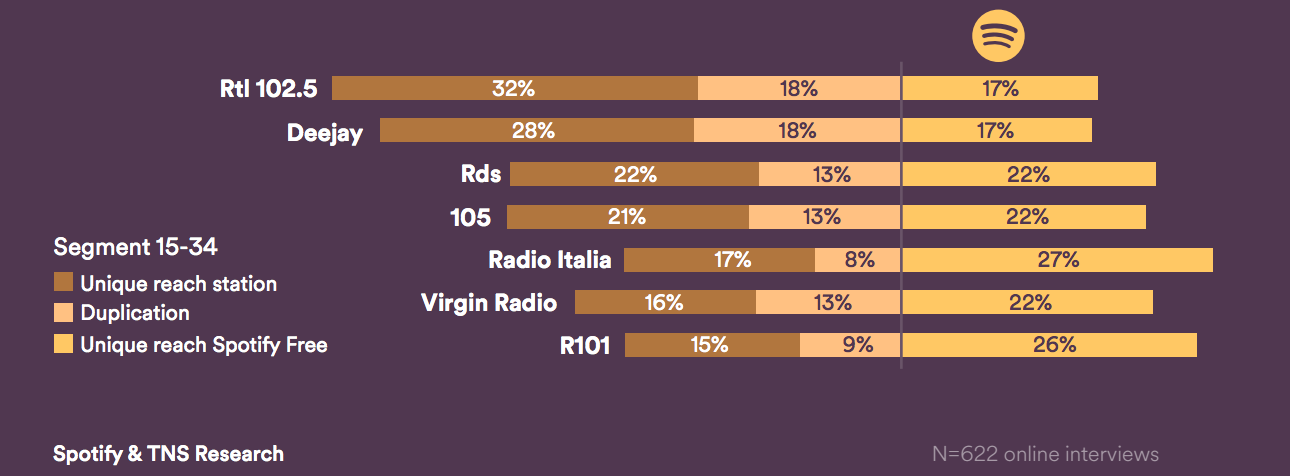

In each region surveyed, more specific trends can also be found. In Germany Spotify added incremental reach to every radio station the same could be found in Italy particularly for the 15-34 segment.

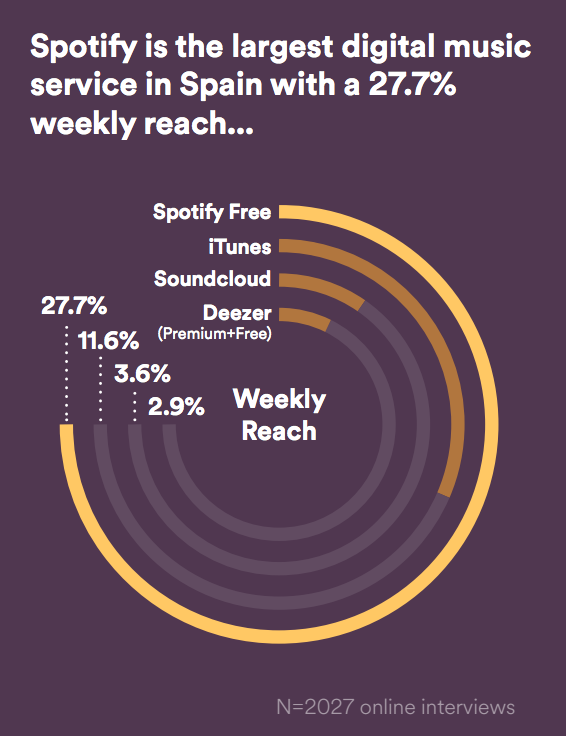

Some countries seem to have jumped on the trend of radio streaming much earlier than others. Spain is one of Spotify’s most mature markets, with an overall brand awareness of 76%, and 94% among 15-24 year old consumers. Turkey and Finland have been less inviting with Spotify being the 6th largest ‘radio station’ in terms of weekly reach.

United Kingdom

- Spotify provides significant incremental reach to every radio station in the UK and across all age groups, with up to 21% added reach among 15-34 year-olds.

- Spotify has a 14% incremental reach in relation to both Heart FM and Capital FM, and 15% in relation to Kiss FM.

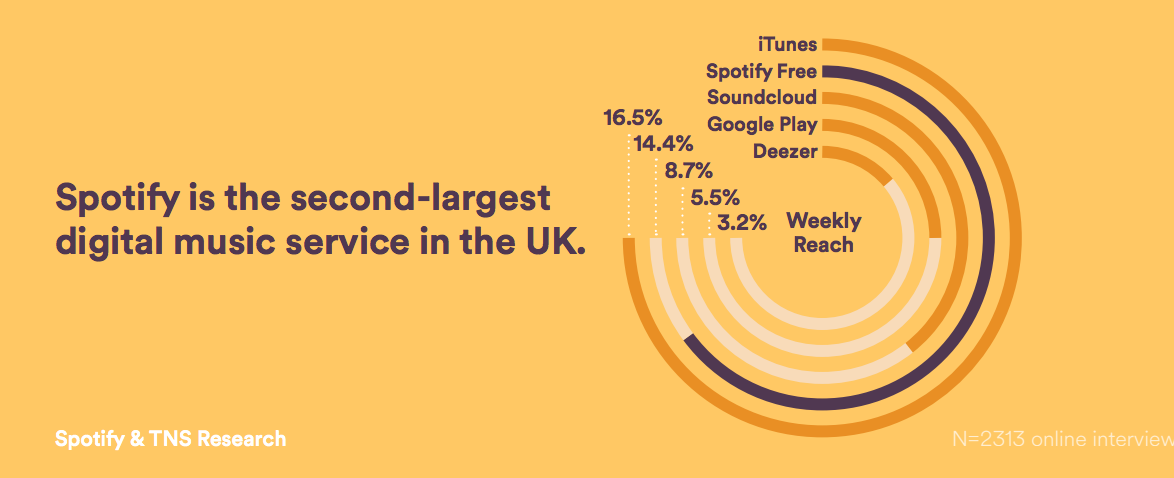

- Spotify is the second most active listening ‘radio station’ in the UK compared to commercial stations.

Germany

- Spotify adds incremental reach to every radio station in Germany.

- With a weekly reach of 8.8%, Spotify is the largest digital music service in Germany.

- Spotify users are on average 8.5 years younger than radio users.

France

- Spotify is the most active listening ‘radio station’ in France compared to commercial stations.

- Spotify reaches 15% of 18-34 year-old consumers in France weekly.

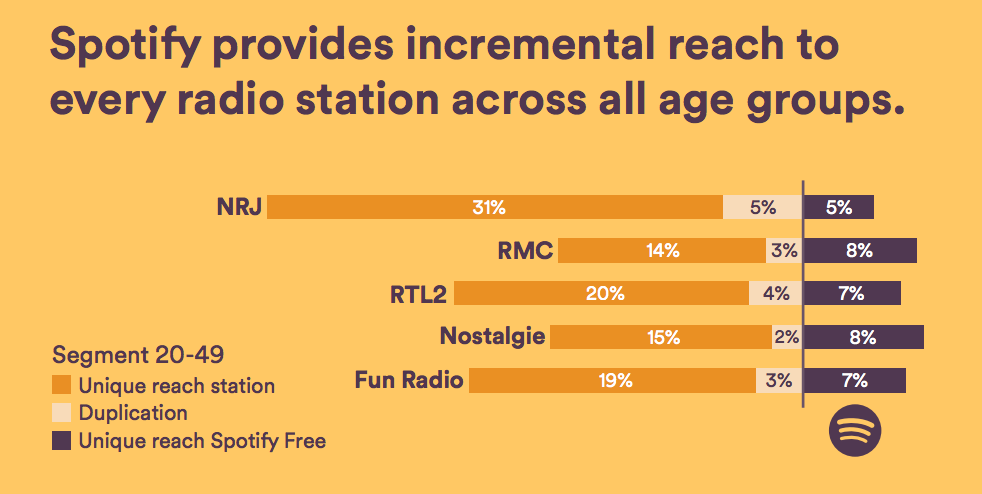

- Spotify provides incremental reach to every radio station across all age groups. For the 20-49 segment, Spotify provides a 5% unique added reach over NRJ, 8% over RMC and 7% over RTL2.

Spain

- With an overall brand awareness of 76%, and 94% among 15-24 year old consumers, Spain is one of the most mature Spotify markets.

- Spotify reaches 27.7% of the overall online population weekly, making it the largest digital music service in Spain and the third largest ‘radio station’ for the 15-34 segment.

- Spotify provides very high unique added reach among young consumers: +36% over M80 Radio, +20% over Europa FM and +16% over Los 40 Principales.

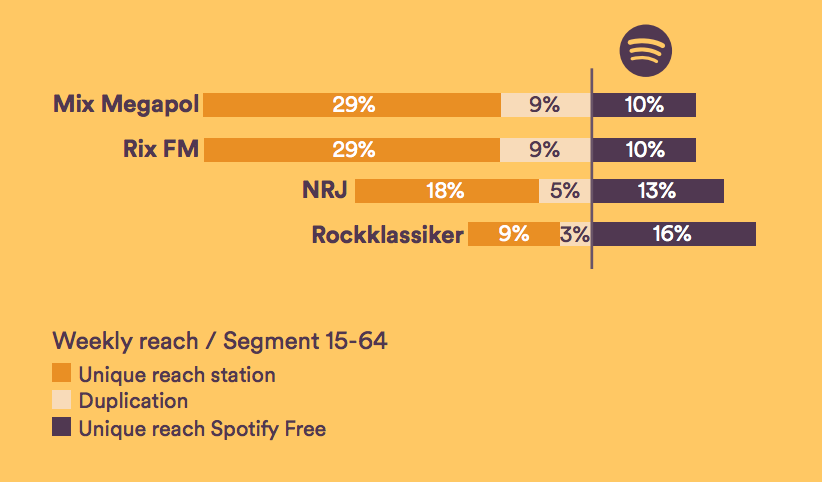

Sweden

- With an overall weekly reach of 18.1%, Spotify is the fourth largest ‘radio station’ in Sweden.

- Spotify provides incremental reach to every radio station across all age groups: +10 over Mix Megapol, +10% over Rix FM and +13% over NRJ.

Italy

- Spotify is the largest digital music service in Italy and the third largest ‘radio station,’ with a 20.7% overall weekly reach that climbs to 35% for 15-34 year-olds.

- Spotify provides incremental reach to every radio station across all age groups, particularly for the 15-34 segment.

Norway

- With an overall weekly reach of 17%, Spotify is the third largest ‘radio station’ in Norway.

- Spotify provides incremental reach to every radio station across all age groups.: +8% over P4, +9% over Radio Norge and +14% over NRJ

Turkey

- With a weekly reach of 20.1%, Spotify is the largest digital music service in Turkey.

- Spotify has overall brand awareness of 49% among the online population, and more than 60% brand awareness below the age of 34.

- Across the 15-34 age group, Spotify is the 6th largest ‘radio station’ in Turkey in terms of weekly reach, which climbs as high as 28%.

- Its unique added reach in the 15-34 segment over Power Turk is +14%, over Power FM is +15% and over Number One FM is +16%.

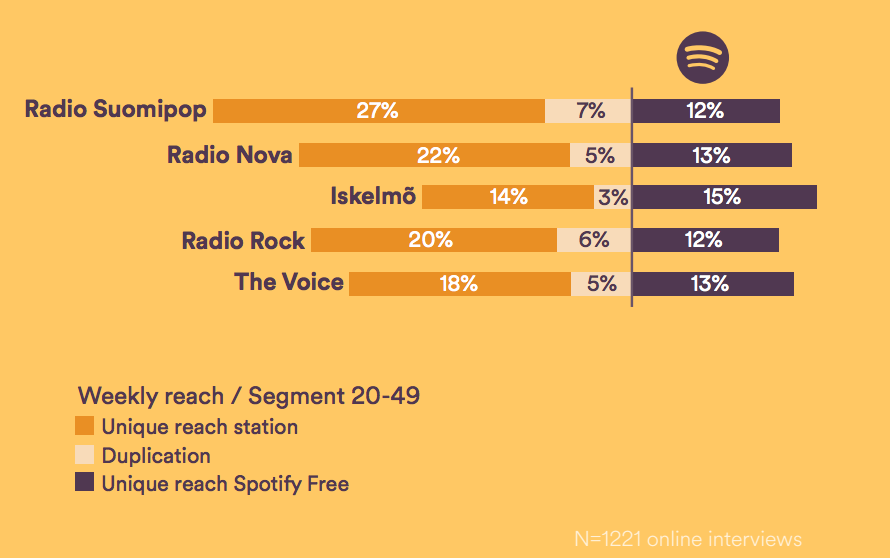

Finland

- With a weekly reach of 18%, Spotify is the sixth largest ‘radio station’ for 20-49 year-olds in Finland

- Spotify provides incremental reach to every radio station across all age groups: +12 over Radio Suomipop, +13% over Radio Nova and +15% over Iskelmõ.

Denmark

- With an overall weekly reach of 13%, Spotify is the third largest ‘radio station’ in Denmark.

- Spotify provides incremental reach to every radio station across all age groups: +8% over NOVA, +10% over The Voice and +11% over Pop FM.

The results reveal key differences in audience listening behaviours that demonstrate why Spotify Free radio streaming and traditional commercial radio are complementary media for audio advertisers. The study showed that commercial radio listening occurs most heavily in the morning and then decreases during the day, and ‘driving’ is the most common activity people do while they are listening. Conversely, Spotify Free listening builds steadily throughout the day and peaks in the evening. For a radio streaming audience, ‘browsing the Internet’ and ‘relaxing’ are the most common activities performed while listening.

Spotify’s Director of Sales in the UK, David Cooper said:

“This TNS study aims to help media buyers understand the quantity and quality of the Spotify audience, and the extent to which Spotify can complement and extend a broadcast media buy. By identifying when and where Spotify reaches an audience that does not engage with radio, we hope to improve both media buyers’ understanding of the audio market, and to grow the audio market as a whole.”

Business Director Exchange – Radio at Mindshare, Thomas Balaam said:

“As the digital audio market continues to grow in the UK it is essential that we can we can understand listening habits and measure the incremental reach digital audio services offer when combined with traditional radio. This research will give us insights that will help us create improved audio advertising plans for our clients.”

Associate Director at OMD Tom Coare said:

“With the audio landscape changing rapidly, it’s great to see Spotify investing in a study like this. The results show that Spotify and radio are complementary media and when used together they improve reach efficiencies for advertisers.”

Spotify’s VP EMEA, Advertising and Partnerships, Jonathan Forster said:

“We believe that there is enormous growth potential in the audio advertising industry, not just in terms of the huge opportunity to connect with a hard-to-reach demographic through Spotify, but also in terms of the potential to grow the European market to the scale of the US audio advertising industry – which is worth around $8 billion; exponentially more than that of Europe currently.”

The survey was conducted through standardised questionnaires via TNS panels and was carried out across 10 European markets in June 2015, having engaged more than 20,000 respondents, with a minimum of 2000 respondents per market.

You can view the full study here.