Australia’s media Agency market has continued to recover from the COVID pandemic according to the Standard Media Index.

In February, agencies reported a reduced year-on-year decline of 2.6% to $557.9 million as the start of a two-speed recovery begins to emerge.

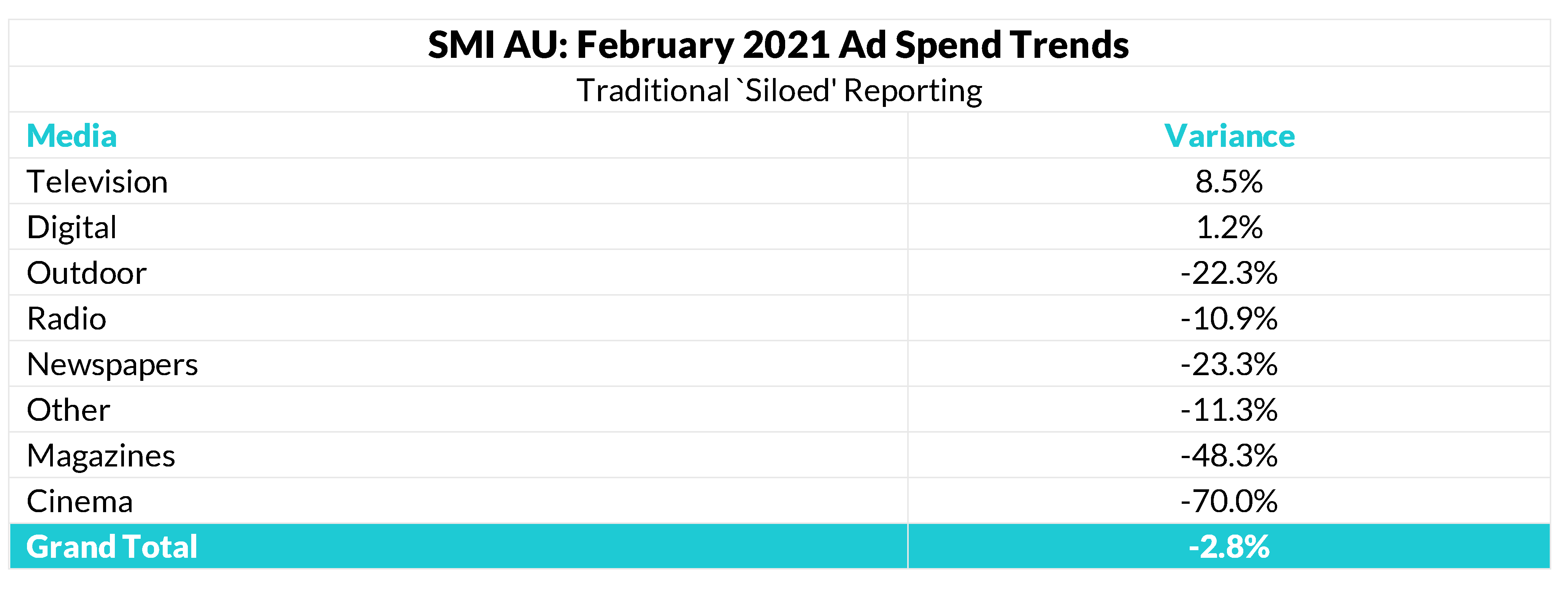

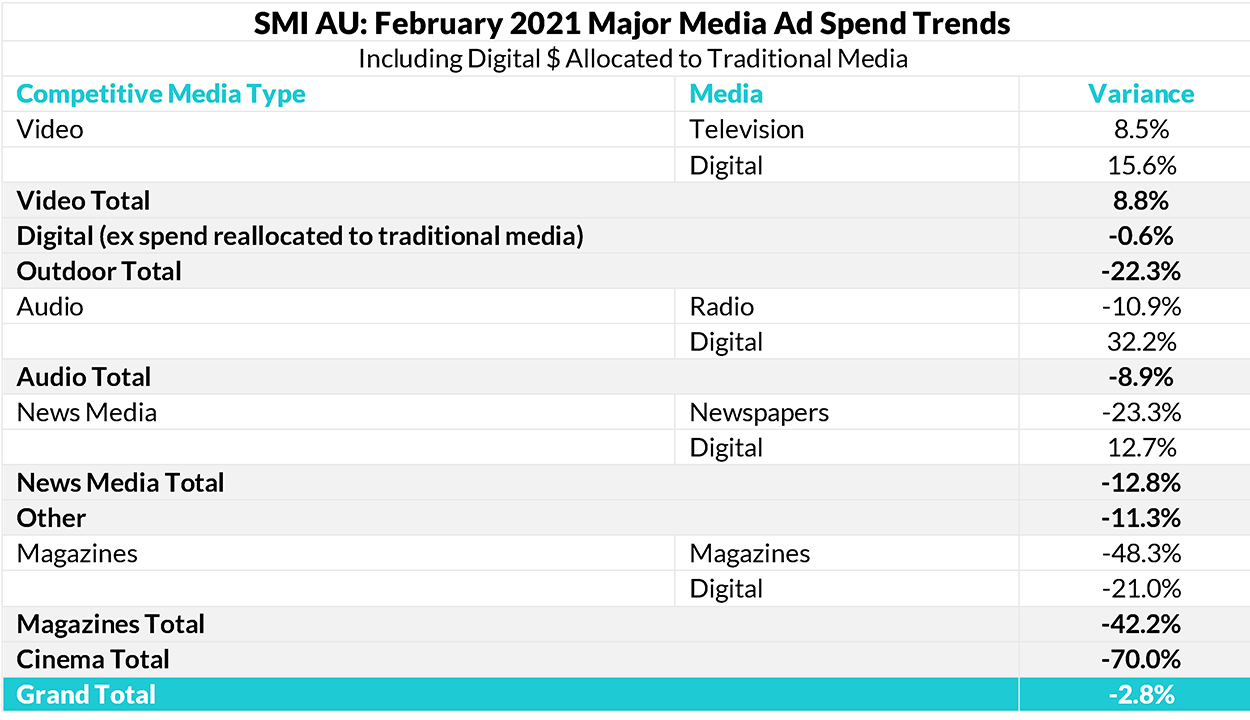

While radio is still down by 10.9%, television returned as the largest media this month after temporarily losing that title to Digital in January as it delivered by far the strongest growth with total bookings up 8.5%, led by Metropolitan TV (+12%), which was buoyed by the delayed Australian Open broadcast.

But Digital ad spend grew just 1.2% this month and, like the broader market. also reported patchy demand with strong growth in ad spend to Social Media (+12.3%) and Video Sites (+12.7%). But the value of ad spend to the largest Digital sector of Search fell by 8.4%.

SMI AU/NZ Managing Director Jane Ractliffe says a two-speed recovery from the COVID advertising downturn was underway in the Australian ad market with advertisers showing clear preferences for media less impacted by the pandemic.

Ractliffe says,“Television delivered very strong growth in February and really underpinned the market as total TV ad spend grew by more than $18 million. But this month’s advertising trends would best be described as patchy given the varying trends across the key Digital and Outdoor media.

“Key Outdoor sectors such as Aviation and Transit continue to be affected by COVID given fears of travel disruption, while in the Digital media there was also a large decline in spending onto comparison websites as well as Search.”

Ractliffe says the slowdown in Digital’s growth was surprising given it has reported double digit gains for the past four months. “But this month we’ve seen a large decline in finance-related spending across the Digital media, while other key categories such as Restaurants and Travel also dented overall Digital demand with reduced ad spending.

“On the positive side, another interesting trend emerging in Digital is the return of spending to premium Content Sites with the total up 7% in February as companies such as NEC, News Corp, Spotify, ViacomCBS and eBay all enjoy strong growth in the value of their directly sold inventory.”

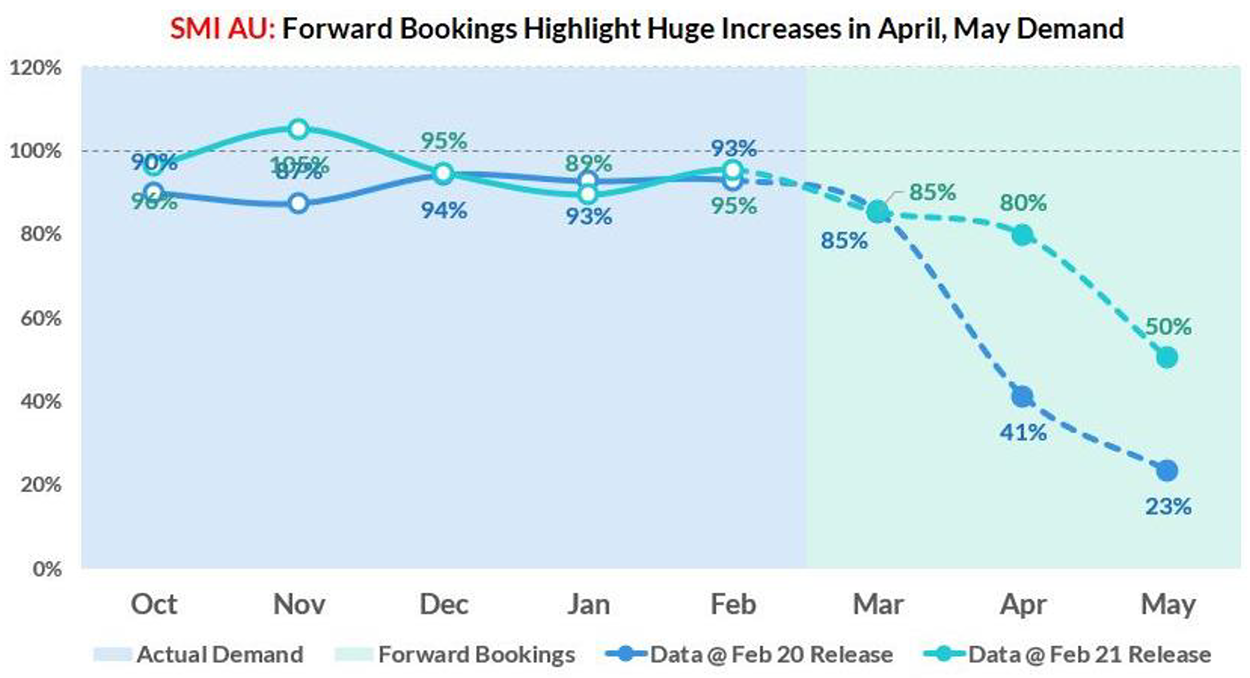

But Ractliffe said this should be the last month of lower ad demand as SMI’s Forward Pacings data shows the entire market will be reporting growth from March onwards given the depths of decline experienced last year.

She says, “SMI recorded the largest declines in history in April and May 2020 so the prior year comparisons are very easy and we’re expecting very strong double digit advertising market growth for all media in those months.

“The only question will be where advertisers allocate their increased ad spend across the media, so subscribers to our Forward Pacings data will have a key competitive advantage as they get an early view of product category ad spend and will be able to direct their sales teams to the categories showing the strongest demand.”

Ractliffe also confirmed that with today’s data release SMI has finished the process of adding the IPG Mediabrands data back into its Australian database, and says, “We are thrilled to have included Mediabrands as it gives all media stakeholders even more confidence in the SMI data as we continue to track the market’s COVID recovery.”

Subscribe to the radioinfo podcast on these platforms: Acast, Apple iTunes Podcasts, Podtail, Spotify, Google Podcasts, TuneIn, or wherever you get your podcasts.