Fairfax Media, a half owner of radio company Macquarie Media Limited, has announced a proposed merger with the Nine Network.

Macquarie Media owns talk radio stations across Australia.

The merger is subject to regulatory approval, but if it gets the nod it will result in the creation of Australia’s largest media company.

In a statement to the Stock Exchange, the companies said they have “entered into a Scheme Implementation Agreement under which the companies will merge to establish Nine as one of Australia’s leading independent media companies.”

The Proposed Transaction will, subject to required approvals, be implemented by Nine acquiring all Fairfax shares under a Scheme of Arrangement(Scheme).Following completion of the Proposed Transaction, Nine shareholders will own 51.1% of the combined entity with Fairfax shareholders owning the remaining 48.9%.

The combined business will be led by Nine’s current Chief Executive Officer, Hugh Marks.

Three current Fairfax Directors will be invited to join the Board of the combined business, which will be chaired by Nine Chairman, Peter Costello and include two further current Nine directors. The combined business will include Nine’s free-to-air television network, a portfolio of high growth digital businesses, including Domain, Stan and 9Now, as well as Fairfax’s mastheads and radio interests through Macquarie Media.

Under the Proposed Transaction, Fairfax shareholders will receive consideration comprising:

· 0.3627 Nine shares for each Fairfax share held (Scrip Consideration)

· $0.025cash consideration per Fairfax Share (Cash Consideration) together, Aggregate Consideration. The Aggregate Consideration implies a:

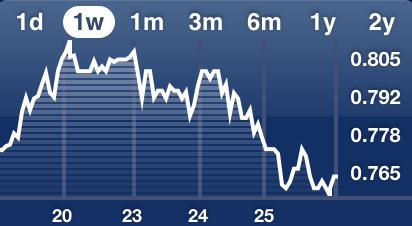

· 21.9% premium to Fairfax’s closing price on 25 July 2018 of $0.770

· 22.6% premium to Fairfax’s one month VWAP to 25 July 2018 of $0.766

The Directors of Fairfax will unanimously recommend that Fairfax shareholders vote in favour of the Scheme in the absence of a superior proposal and subject to an independent expert concluding that the Proposed Transaction is in the best interest of Fairfax shareholders.

Commenting on the Proposed Transaction, Nine’s Chairman Peter Costello said:

“Both Nine and Fairfax have played an important role in shaping the Australian media landscape over many years. The combination of our businesses and our people best positions us to deliver new opportunities and innovations for our shareholders, staff and all Australians in the years ahead.”

Fairfax’s Chairman Nick Falloon commented:

“The Fairfax Board has carefully considered the Proposed Transaction and believesit represents compelling value for Fairfax shareholders. The structure of the Proposed Transaction provides an exciting opportunity for our shareholders to maintain their exposure to Fairfax’s growing businesses whilst also participating in the combination benefits with Nine.”

The merger is expected to achieve “cost savings” of $50 million, presumably through economies of scale and redundancies.

The combined entities will “unlock the potential for significant value creation by combining the content, brands, audience reach and data across the respective businesses, including majority owned group companies Domain and Macquarie Media,” according to information released about the merger.

Fairfax shares had been falling steadily over the past week before news of the merger was released, however, Fairfax shares rose this morning as information of the merger became public.

Fairfax shares had been falling steadily over the past week before news of the merger was released, however, Fairfax shares rose this morning as information of the merger became public.

The 95 page information document about the proposed merger has now been released to the stock exchange. Read it here. There are just three mentions of Macquarie Media in the document.

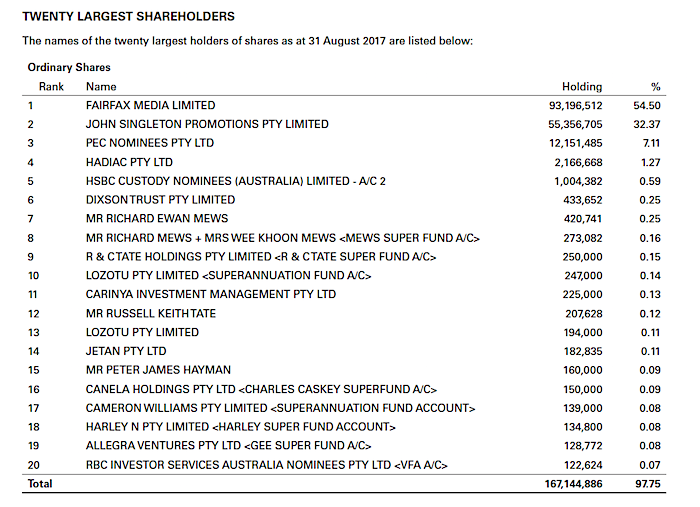

Options for MML include Macquarie Media buying the 54% of shares from Fairfax before or during the merger process, or waiting until the merged entity decides if it wants to keep its share in the radio company. If the new company wants to own radio stations as well as its tv, print and digital assets, it may end up buying the remaining 46% of MML and bringing radio into the merged entity, or it might do the opposite and offer its share of MML for sale. See the list of top 20 MML shareholders below.

Prime Minister Malcolm Turnbull has welcomed the announcement, saying the merger was only possible because of media ownership reforms he made last year. The Labor opposition, however, has expressed fears about greater concentration of media ownership andjob losses.

An internal memo to Fairfax staff from CEO Greg Hywood, confirmed that ther merged company will be called ‘Nine,’ putting to rest the 150 year old Fairfax name, which dates back to when the company was owned by the Fairfax family.

Below is a chart from the merger document, detailing all the media assets of the combined company, if the merger goes ahead. The chart has accidentally left of 4BC, but Fairfax has told radioinfo that 4BC is indeed part of the merger plan and that leaving the 4BC logo off the chart was just a mistake.

Fairfax is Macquarie Media Limited’s largest shareholder, as shown in this shareholder chart from the company’s most recent Annual Report.

MML/Fairfax Media presenter Neil Mitchell on 3AW commented on the deal, as news broke and on MML station 2GB, Ross Greenwood analysed the deal.