Changing media business models was the topic of a session at the Asia Media Summit in Delhi.

A panel of speakers looked at how business models are changing and how broadcasters can respond.

“The largest taxi company Uber, doesn’t have a fleet, the largest accommodation company AirBnB, doesn’t own any hotels. The largest news media company Facebook, doesn’t produce any content,” said David Hua from ABC Australia (pictured above).

Due to changes in technology that have spawned new businesses, older businesses are finding it harder to make money in the modern business environment. The prestige of owning a media company has also declined. “Fragmentation is shattering everybody’s business models and dreams,” said Hua.

One of the key factors that characterize new business models is personalisation.

Businesses have the opportunity to personalise content for each of their consumers, and those that are doing so can achieve good results. But there is a caution to be remembered, companies need to respect the line between personalisation and privacy. “While people may share their personal information with a company to enable some personalization, they don’t want their data used beyond what they gave it for,” Hua told delegates.

Quoting Seth Godin, Hua reminded the audience that “people don’t buy good and services, they buy relations, stories and magic,” suggesting that media companies must get closer to their audience, rather than just trying to blatantly sell things to them.

David Hua has worked in many sections of Australia’s national broadcaster in his career and is now Head of International Strategy. In his time working in Radio, he was responsible for developing ABC Open, which partnered with communities to enable them to tell their stories better, in their own voices, and use the ABC Platform to share that message. He used it as one example of how traditional media can use new techniques to make programs with their audience, not just for them.

Rahul Kapoor from Google India previously worked in media sales and is now Head of Large Parternships for Google (which owns YouTube). He spoke about marrying traditional business models with new business models.

“There has been a surge of content availability, but also corresponding increases the costs of content production. Our partners are always asking us how to maximize their return from the content they create.”

“There has been a surge of content availability, but also corresponding increases the costs of content production. Our partners are always asking us how to maximize their return from the content they create.”

He said Google is constantly working to deliver the right technology and platforms to help content makers achieve success.

“We want to ensure that when great content is created, there is a way for those creators to distribute and monetise it.”

Discussing monetisation, he said one of the key factors bringing advertisers to digital platforms is that, unlike traditional broadcasting, online platforms have lots of data about the audience. Because of this the opportunity for programmatic advertising has emerged. “It is just like traditional advertising, but using data to make better, faster decisions,” said Kapoor.

Why are advertisers going programmatic? They want to ensure they are “getting the right message to the right audience,” according to Kapoor. They also want a unified view of where consumers are going to consume their content. “The top 100 advertisers in the world have done at least one programmatic ad campaign.”

Google did a study that found there was 57% more efficiency and 11% more reach than when ads were booked manually. Dynamic ad insertion also allows smarter positioning of ad breaks, according to Kapoor.

When there are load time issues and latency there is always a big fall in traffic and revenue. Improved delivery and smarter ad breaks are one way YouTube is trying to reduce load time issues and improve the audience experience.

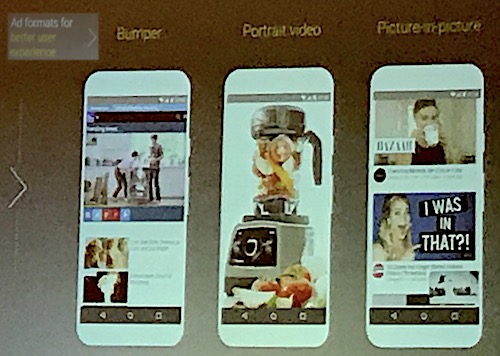

Ad formats are now being tailored for the digital experience: Bumper ad (6 seconds bumped into the show), Portrait video (only 5% or creative is made for portrait format so this function converts other sizes automatically to portrait format), Live Advertising Games and Picture in Picture ads.

Inserting different ads on your digital screen to what is broadcast on your tv broadcasts and leveraging machine learning to streamline transaction models are two more ways the Google and YouTube are trying to deliver better ad experiences on their platforms..

Louis Hernandez, from investment bank Black Dragon Capital said the Media and Entertainment economic category globally last year was the number one industry affected by digital transformation.

‘Yield per asset’ is much more complicated than in the past according to Hernandez. “Digital only players are experiencing growth, while traditional players have to manage transition while keeping revenue up. It is a difficult challenging environment but with opportunities.”

‘Yield per asset’ is much more complicated than in the past according to Hernandez. “Digital only players are experiencing growth, while traditional players have to manage transition while keeping revenue up. It is a difficult challenging environment but with opportunities.”

We know there is rapid acceleration of content and ways to consume that content. It’s a good news/ bad news situation.

“The good news is that per person media content consumption has increased by 50%. But the economic challenge is while there is increased consumption there is more fragmentation because there is more content available.

Competition is more intense, media companies must fight to differentiate themselves and make their content available on more platforms… A challenging but exciting time. Media is a great place to invest, but it needs to be navigated carefully.”

The yield curve for most media businesses shows choice up, costs up and consumption down, but there is hope for quality media brands. “There is so much content in the digital world that people can’t decide or find what to listen to, so the trend is now going back to trusted brands to tell us what to listen to, but those brands have to work hard to monestise that advantage,” he said.

More reports from the Asia Media Summit at our other publication AsiaRadioToday.