Nine Radio’s profit (EBITDA) is down 21% in its first full year of being wholly owned by Nine Entertainment, due mainly to the effects of the covid pandemic.

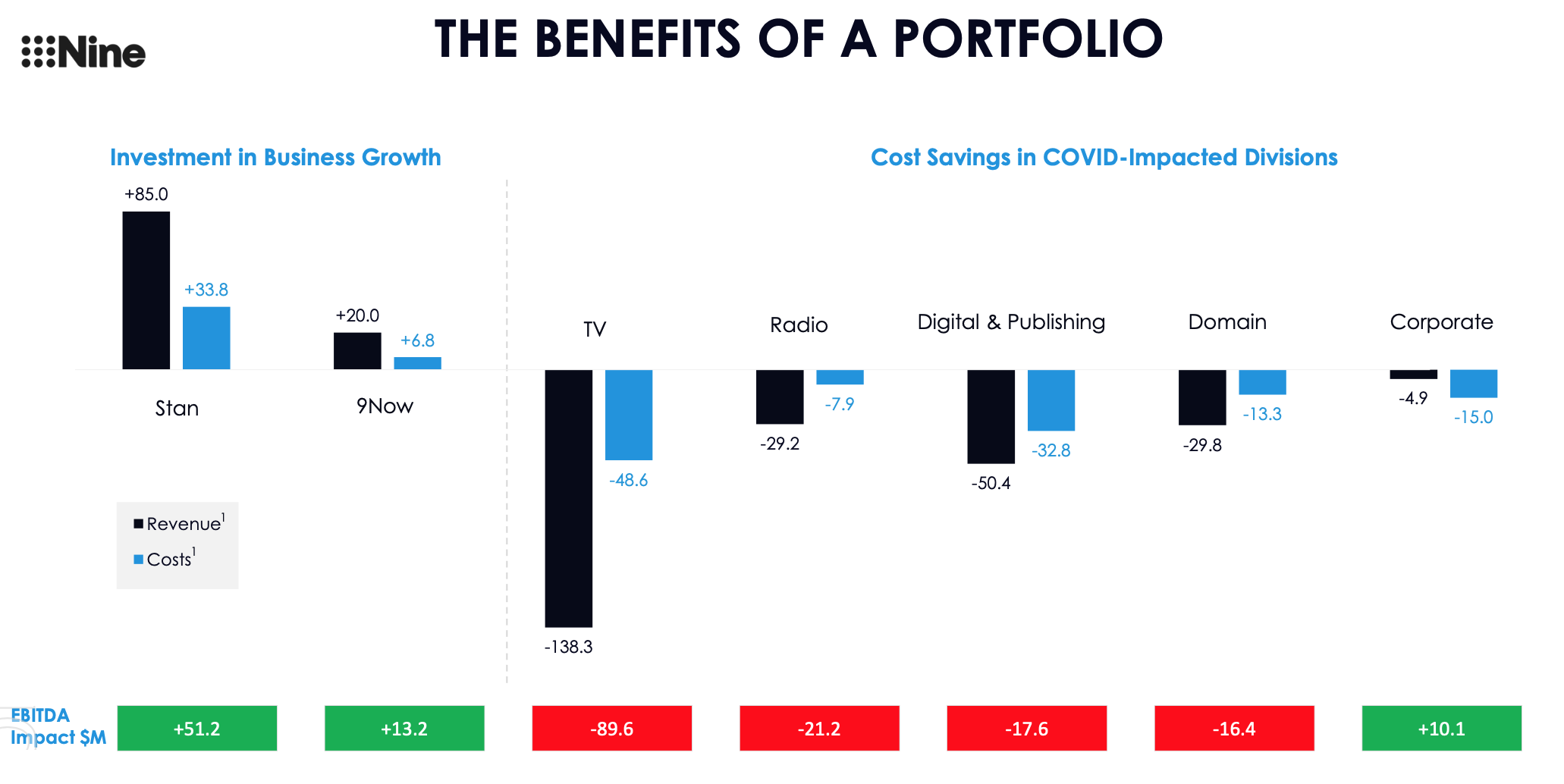

Nine’s digital products increased profit, while television profit declined by 89% and publishing was down 17%.

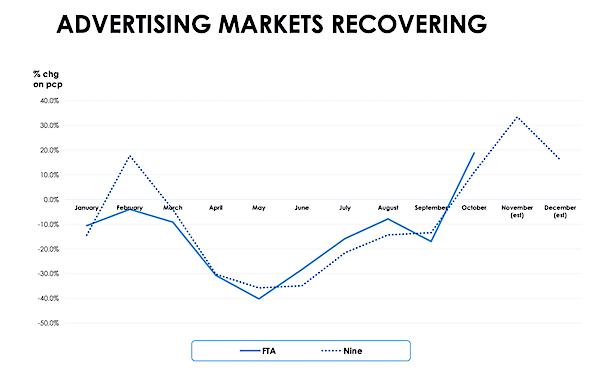

Like most businesses, Nine was hit hard in the middle of this year by the covid advertising downturn, but has recovered in recent months.

In FY20, on a continuing business basis, Nine reported Group EBITDA of $397 million, which, on a like-basis (before changes to the accounting standard), was down 16% on FY19.

Revenues across the Group fell by 7% to $2.2 billion, as the operating environment impacted on all advertising markets.

Net Profit after Tax was $141 million, which equated to a decline of 19% on a like for like basis. After a specific non-recurring item costing $665 million, after tax, the bulk of which related to non-cash accounting adjustments, a statutory loss of $509 million was reported.

Earnings per share was 8.3c and a fully franked dividend of 7c per share was declared across the year.

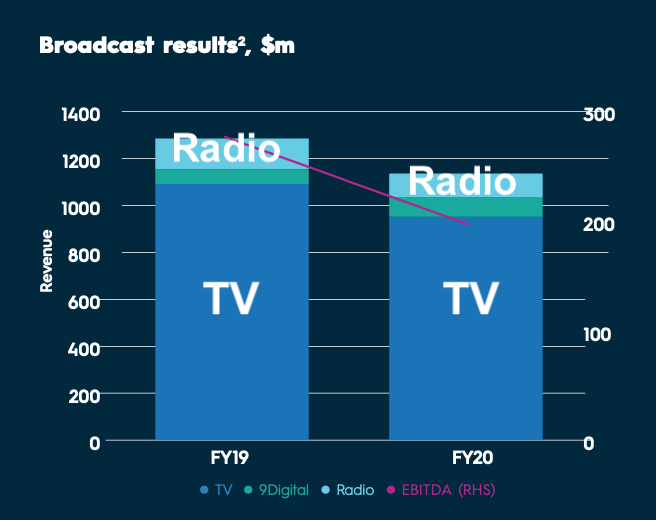

Nine’s Broadcast division, which comprises Nine Network, 9Now and Nine Radio (previously Macquarie Media) reported EBITDA of $197 million on revenues of $1.1 billion for the year. Nine Radio is only a very small part of the company’s Broadcast portfolio, which is dominated by television.

Nine paid out 80% of net profit to shareholders and did not receive any Jobkeeper benefits from government.

At the company’s annual general meeting, Chairman Peter Costello said the company’s results are “pleasing in a difficult year.”

The way the company has navigated the covid advertising downturn shows “the benefits of diversity,” said Costello.

“Our new products have proven their worth in this downturn… We have emerged a stronger and more focussed company… We have transitioned from a free to air tv to a digitised content company.”

CEO Hugh Marks said the results from Nine Radio were “disappointing,” but there has been “a pleasing growth of audience share after the restructure of Nine Radio in recent months.”

Explaining the restructure, Marks said the company “gave consideration to the next 50 years of our business” and made decisions for the long term. “The work that was done by Tom Malone and his team to reset the radio networks was incredibly successful. We anticipate that the audience success will translate to increased revenue in the future.”

Marks and Costello flagged a long term strategic shift for the company away from traditional advertising, which currently makes up about 80% of revenue. They expect that 35% of group revenue in future will come from subscriptions, “reducing exposure to advertising.” The company will also target more “adressable advertising” in future in its revenue mix.

At the top level of the company, radio is an afterthought as far as the balance sheet is concerned.

Speaking to radioinfo after the AGM, Hugh Marks said radio is “immaterial,” when asked about future audio business strategies. Nine Entertainment has owned seven influential analog radio stations and a similar amount of digital stations for a full financial year now, it remains to be seen whether that attitude will change the longer the company owns its radio assets.

Asked about the latest just-announced Senate inquiry into media, Chairman Peter Cosetello said “the Senate is entitled to inquire into anything… but [the inquiry] is unlikely to tell us something we don’t already know.”

Responding to our question about use of the word “legacy” to describe tv and radio, which makes us think of a dusty old 1940s mantle radio with cobwebs all over it, Chairman Peter Costello promised to get the company’s marketing team onto the issue to come up with a better word in next year’s annual report. We think that is a good idea, because, if radio and tv companies use terms that paint analog broadcast platforms into the “old fashioned” category, they will fail to attract the ongoing interest of advertising agencies. While there is clearly a strategic move to digital in the company, Hugh Marks commented that it is a very long term generational strategy, not a short term one.

With the bushfires and the US election over, and the search for a covid vaccine closer to success, Hugh Marks wondered what will be the next big thing to drive audiences to news content. “Is there something else that will interest people… We expect to see some audience drop off [from news radio and tv news] over the next few months as these huge news stories are resolved.”