Update: The ACCC has given approval for the merger to go ahead. More here.

Steps towards the merger of MRN and Fairfax Radio networks are progressing, with an explanatory memorandum this week being delivered to Macquarie Radio Network shareholders.

Financial adviser for the deal is 15% share holder Mark Carnegie’s company M H Carnegie & Co. Minter Ellison is the legal adviser.

The Explanatory Memorandum is aimed at preparing shareholders to vote on the merger (if it approved by regulators) during an Extraordinary General Meeting to be held on 25 March.

The Proposed merger transaction involves MRN acquiring 100% of the share capital of Fairfax Radio Network Pty Ltd, in exchange for the issuance of new MRN Shares to Fairfax and an equalising cash payment to Fairfax of approximately $18 million based on the net debt positions of FRN and MRN. On Completion, existing MRN shareholders will hold 45.5%, and Fairfax will hold the remaining 54.5%, of the MRN Shares on issue.

MRN Directors have unanimously recommended that shareholders vote yes to the proposed transaction, and the company’s major shareholders, the Singleton and Carnegie families, support it.

The Directors consider that the proposed transaction will deliver significant benefits for MRN and that it represents “an attractive opportunity to unlock significant cost and revenue synergies from enhanced networking and sales opportunities, and provide national advertisers with ease of access to the increasingly important 45 – 69 year demographic which all seven stations in the combined group attract.”

The ACMA has to approve the deal and the ACCC also needs to have no objections, before it can proceed. John Singleton is on record criticising the approval and regulatory process as being too slow and bureaucratic.

MRN will finance the deal with borrowings. “The payment of the cash component of the purchase price for the Proposed Transaction is to be funded by way of a new debt facility to be established, or an existing debt facility to be refinanced, by MRN.”

The potential downsides of the deal for MRN shareholders are listed in the memorandum as:

• the Proposed Transaction may make MRN a less attractive takeover target; and

• unforseen additional integration costs may arise as MRN’s and FRN’s operations are combined…

• the Constitution Amendment gives Singleton influence over the Combined Group’s financial and operating policies; and

• Singleton may exert that influence in ways that are not consistent with the preferences of other MRN shareholders.

MRN proposes to amend its Constitution to provide its major shareholder, Singleton, with the right to appoint one nominee director to the Board, so long as it holds in excess of 20% of the Shares on issue. This right will expire on the third anniversary of the merger approval date.

The nominee director will be subject to removal by the Shareholders in general meeting under section 203D of the Corporations Act.

Under a staff incentive scheme, most people working at MRN hold small parcels of shares in the company. The station’s key personalities also hold shares in the company, although Alan Jones is known to have had his holdings reduced recently after falling revenue in his breakfast show.

After the deal completes, MRN owners will have their shareholdings diluted, with John Singleton expected to end up holding about 32% of shares after the merger and Mark Carnegie about 7%.

The memorandum says the combination of MRN and FRN will produce Australia’s leading news-talk radio operations with a range of market leading presenters and programs.

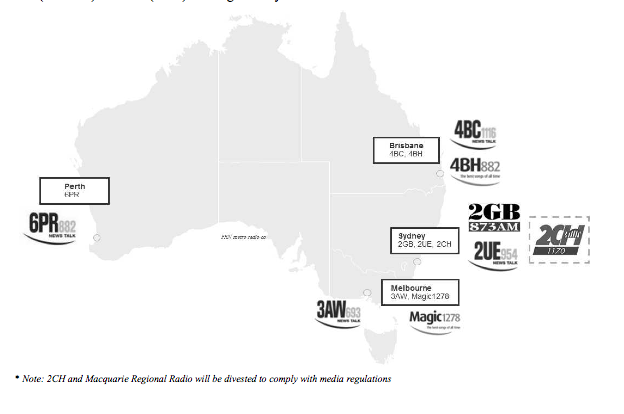

“The proposed transaction combines the key Sydney (MRN’s 2GB) and Melbourne (FRN’s 3AW) metropolitan markets as well as an additional five radio stations across Australia: 2UE (Sydney), Magic 1278 (Melbourne), 4BC (Brisbane), Magic 882 (Brisbane) and 6PR (Perth) creating the only national commercial news-talk network in Australia.”

As part of a functional review to take place after the merger, “the Combined Group will examine programming across various stations, with a view to generating greater value for shareholders through strategies that may include the syndication / networking of leading content across various markets,” says the memorandum.

The EGM will take place at 11am on 25 March at the MRN Offices in Sydney.