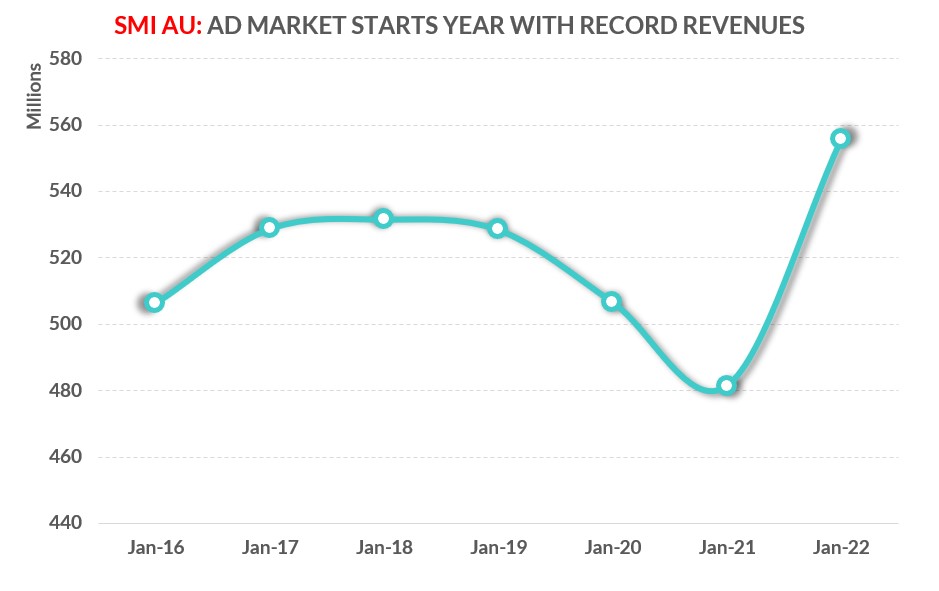

Australia’s Media Agency market has started 2022 year with a bang, lifting the value of ad revenue in January by 15.4% year-on-year to now be 5.1% above the pre-covid January 2019 total.

That result has further strengthened the record figures already being seen across this financial year with the ad spend total up 16.1% to move through the $5 billion mark for the first time in this seven month period.

SMI AU/NZ Managing Director Jane Ractliffe said the results are a further testament to the strength of the Australian advertising economy as it continues to move well past the covid era.

“The value of Australia’s advertising market in January is not only well above pre-COVID levels but also 4.5% above the last record level of January ad spend set in 2018, which underscores the strength of the ad demand we’re currently experiencing,” she says.

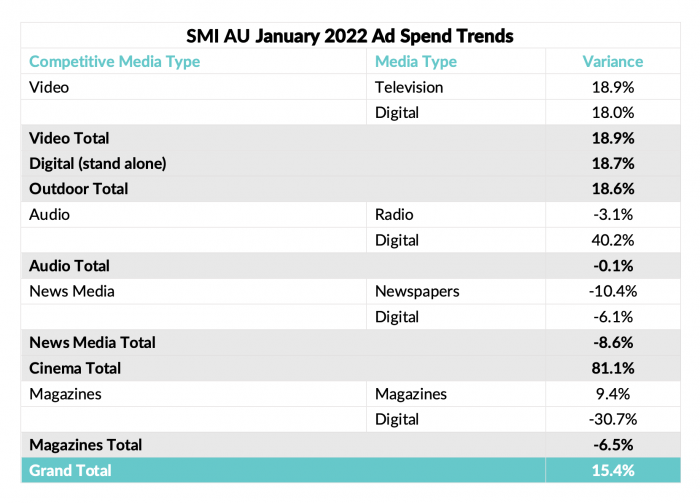

Audio was the poorest performing category in an otherwise good month across most Australian media, but there is a reason for that. Ractliffe has told radioinfo that Metro radio performed well, but that regional radio ad figures were lower than usual, something that she attributes to the transition from Grant Broadcasters to ARN and the changes taking place at The Regional Radio Sales Network (TRSN). Broadcast radio ad spend declined by 3.1%, while Digital Audio advertising increased strongly, up 40%, but from a lower base than broadcast advertising, making the overall radio category decline by 0.1%. This is consistent with what we heard from then radio CEOs we talked to recently.

Digital media again emerged as the largest stand-alone media advertising category in January with revenues up 18.7%.

The strongest growth has been in the Social Media sector.

TV ad spend also continued to grow (+18.9%) although this month it was buoyed by the return of the Australian Open tennis tournament into January, which was postponed from February last year due to covid.

Given the difficulties the Outdoor industry has endured through the covid period, the industry now seems to be bouncing back, with the latest data showing January ad spend lifted 18.6% year-on-year to be just $1.8 million shy of its pre-covid January 2019 total.

Cinema Advertising’s recovery also continued, with ad revenues up 81% in January and have now trebled over the previous financial year period.

The Government category has emerged as the market’s largest for the first time in January, after lifting the value of its media investment by 51% year-on-year as various Governments continue covid messaging. With an election expected by May, media CEOs are expecting good revenue from election advertising in the next few months to supplement other categories.

However, Ractliffe says the SMI data shows the current level of ad demand was being fuelled by a concentrated number of product categories, with 18 major categories reporting lower ad spend than in January 2019.

“The growth in Government category ad spend is underpinning the market, but there are many large categories which are spending less now than in January 2019 with key examples being Retail, Domestic Banks and of course Automotive Brand,” says Ractliffe. Ciaran Davis confirmed this view in our recent discussion with him about forward ad bookings for ARN

“Media companies need to be well across these changing trends to maximise revenues during this high- growth period,” she says.