Despite subdued market conditions, the Australian Radio Network (ARN) produced a solid financial result in the 12 months ending June 2012 (JYE 2012) on the back of impressive ratings improvements in some key markets and demographics.

ARN, Australia’s second largest commercial metropolitan radio group in terms of revenues and profits, achieved a financial trifecta by: increasing its revenues in a flat overall metro radio ad revenue market environment, continuing to maintain control over operating costs and consequently generating good growth in earnings before interest and tax (EBIT) over the year ending June 2012.

While ARN, like its locally based co-owner APN News & Media Limited (APN), has a 31 December financial balance date, Global Media Analysis (GMA) re-cast data contained in APN’s half-yearly reports to the Australian Securities Exchange, in order to restate ARN’s key financial performance indicators on a June year end (JYE) basis extending back over an nine year period to JYE 2004.

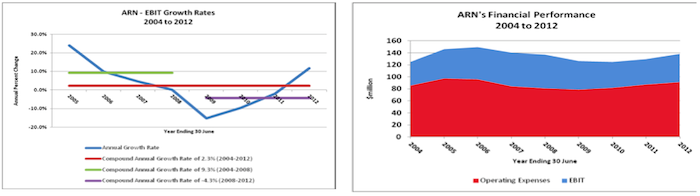

GMA’s analysis shows that, during JYE 2012, ARN managed to improve each of its three key financial performance metrics by:

increasing total revenues by 6.8% to $138 million;

limiting operating cost growth to only 4.5% or $91 million; and

growing EBIT by 11.7% to $47 million, which represented an improved profit margin of 33.9%.

The impressive financial performance in JYE 2012 also represented a welcomed financial turnaround for ARN, which undoubtedly would be satisfying to the current management team who have worked hard over the past couple of years to reverse a number of serious adverse trends which had included: some disappointing ratings results in the three East Coast metro radio markets; below market revenue growth; declining margins; and reduced profits.

A Return to Solid Revenue Growth

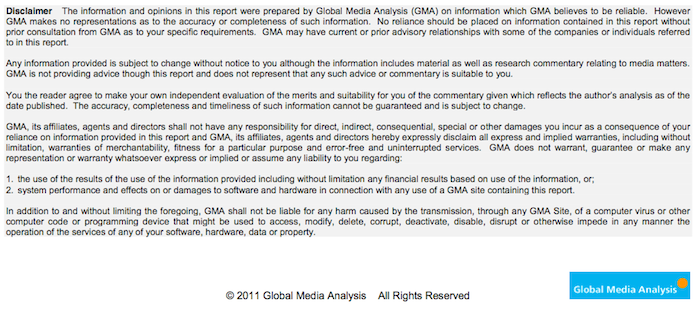

After declining for four consecutive years between JYE 2007 and JYE 2010, ARN’s revenues increased over the past two years, with JYE 2012’s growth of 6.8% being sizeably above the metro radio industry’s norm. ARN’s above– market revenue growth in JYE 2012, reversed a six year trend between JYE 2006 and JYE 2011 when the network under-performed relative to the overall metro market.

Between JYE 2004 and JYE 2011, ARN’s revenue growth was fairly anaemic. For example, in the five years between JYE 2004 and JYE 2008 which preceded the Global Financial Crisis (GFC), ARN’s revenues had experienced a compound annual growth rate (CAGR) of just 2.4%, while post the GFC the CAGR was reduced to only 0.2%.

Profits Heading Back Towards Historical Averages

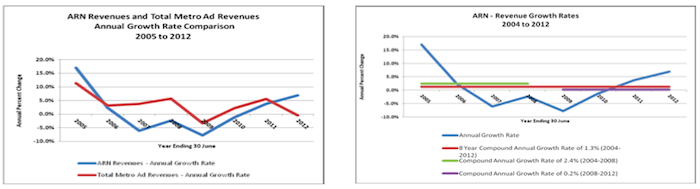

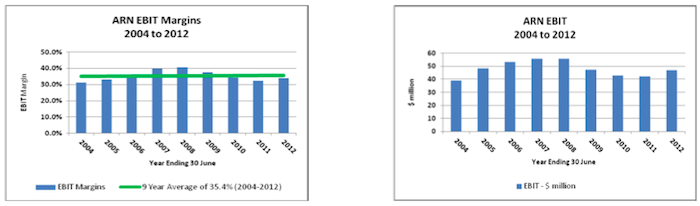

Despite its widely acknowledged ability to control operating costs, ARN was nevertheless unable to prevent an erosion in both margins and aggregate profits (as measured by EBIT) between JYE 2008 and JYE 2011 in a sluggish post- GFC environment when its own revenue growth dropped to below the industry’s already low levels.

However, its ratings and revenues rebound in JYE 2012 has taken ARN back to near average historical (2004-2012) profit levels and margins. ARN’s EBIT margin of 33.9% in JYE 2012 was not far below its 9 year average margin of 35.4% and similarly that period’s EBIT of $47 million was not far the 9 year average EBIT amount of $48 million.

A further encouraging indicator for ARN is that its annual EBIT growth rates have actually been trending upwards since JYE 2010, albeit off of a negative base in JYE 2008 and JYE 2009.

But most importantly, despite the volatility of its revenues and profits, metro radio remains an industry with reasonable future growth prospects and ARN, as one of the industry’s most experienced operators, is therefore likely to continue generate future margins and aggregate profits which will remain the envy of many other traditional media companies.

This is the next in a six part series of reports by Bob Peters in which he examines trends in metropolitan radio advertising revenues over the past decade.âďż˝¨

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Prior to establishing GMA in early 2001, Bob was a Director of Corporate Finance with ANZ Investment Bank and prior to that Capel Court Investment Bank.

In both his current and previous positions, Bob provides advice to corporate clients in relation to: takeovers & mergers; asset acquisitions & disposals; debt and equity fund-raisings; financial planning & restructuring; business & asset valuations; financial & economic feasibility studies; and the formulation of business strategies.

Bob holds a Bachelor in Economics degree from the Wharton School of Finance & Commerce at the University of Pennsylvania; a Master of Business Administration from The City University in London; and a Master of Economics degree from LaTrobe University in Melbourne.