The just released fifth edition of Deloitte’s Media Consumer survey, provides a snapshot of how Australians are consuming dfferent media and entertainment and how this has changed over time.

This year’s report sees the evolution of social media, “the rise and dominance of social media networks as entertainment destinations in their own right.”

The findings are a snapshot of how Australian consumers are responding to all things media and digital.

TV advertising was the most influential form of advertising again this year (68% of respondents), followed by newspapers (53%) and ‘online’ advertising (47%). This year sees not only the category ‘online’ awash with sophisticated forms of digital advertising, but specifically, recommendations on social media have surpassed the influence of TV advertising for the first time.

Word of mouth is still the primary influencer on purchase decisions, with three quarters (76%) of survey respondents identifying recommendations from friends, family and acquaintances as having a high or medium influence on their buying decisions.

Listening to music (35%), reading newspapers (19%), listening to the radio (17%) and reading magazines (8%) have all remained stable in terms of popularity over the past year.

Ten years ago, the media conversation was all about convergence, primarily of devices, according to the Deloitte survey. But in 2016, “what we are experiencing can better be considered as a function of divergence. This is manifest in the multitude of devices available on which to consume content, the platforms used to distribute it, the myriad models to pay for it, the number of brands that shape our media experiences and the diversity of our changing consumption patterns.”

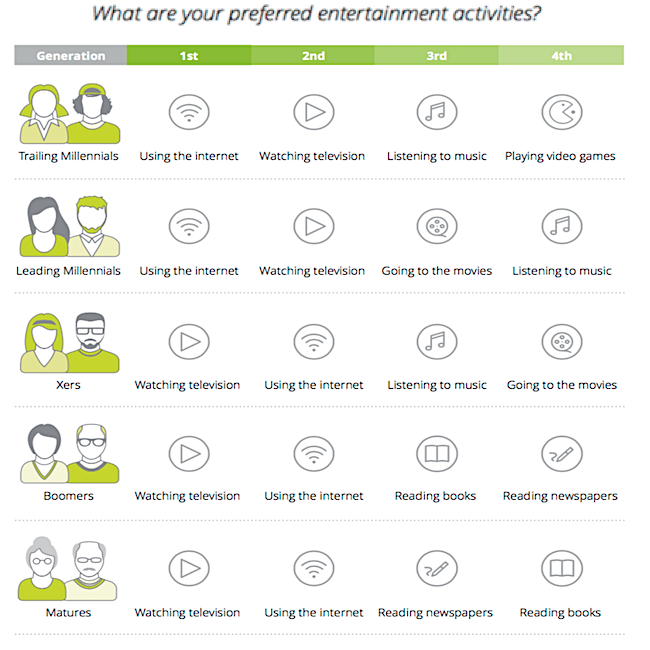

But, despite rapid change in the options for how we interact with and consume media, some of our preferences for entertainment have not shifted dramatically.

Watching TV on any device is still Australians’ preferred entertainment activity (62% of survey respondents rate it in their top three), just ahead of using the internet for social or personal interests at 60%. These two activities were equal first in 2015 and have held the top two spots over the last five years.

The proportion of survey respondents using social media as their primary source of news has doubled to almost one fifth of all respondents – 18% this year, up from 9% in 2015 and higher than in the US (17%) or Norway (13%).

Social media’s status as a trusted source of news has extended into what was once the preserve of venerable news brands, mastheads and bulletins.

The challenge of monetisation models in news continues. The percentage of total households paying for news subscriptions has declined further to 17% (down from 21% last year and a 10% CAGR decrease since 2012), where the percentage paying for magazine subscriptions is stable at 14% (compared to 15% last year and having declined 15% CAGR since 2012).

Consumers are still reluctant to pay for online news subscriptions, just 9% of respondents indicate that they are willing to do so, which has been consistent since 2014 (8%) and is on par with the US (9%).

Where consumers are willing to pay for news online, the rationale in 2016 is different. The primary reason for paying for news online is ‘in-depth news analysis’, indicated by 52% of those respondents that are willing to pay.

TV is the most significant source of news, followed by social media, then radio. Radio usage shows strength in the older consumer segments, but is weaker in the younger segments.

The full survey is available here.