Media strategic consultant Bob Peters has crunched the numbers to show why. Despite radio advertising revenues growing by only 0.2% to reach $205m in the fiscal year (FY) ending 30 June 2012, Melbourne’s metropolitan radio advertising revenues were just $5m, or only 2.5%, less than Sydney’s, according to industry-sourced statistics compiled by accounting firm Deloitte and published by the commercial radio’s industry representation group Commercial Radio Australia.

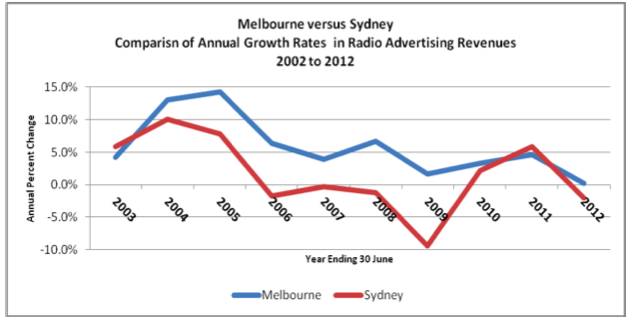

Melbourne’s annual radio ad revenue growth rate only needs to exceed that of its northern rival by about 2.8 percentage points for one more year in order for it to snare the metro radio revenue crown, and such a result may well be achieved given that over the past decade Melbourne enjoyed a compound annual growth rate (CAGR) in radio advertising revenues of 5.7% compared with Sydney’s much lower growth rate of only 1.6% per annum (pa).

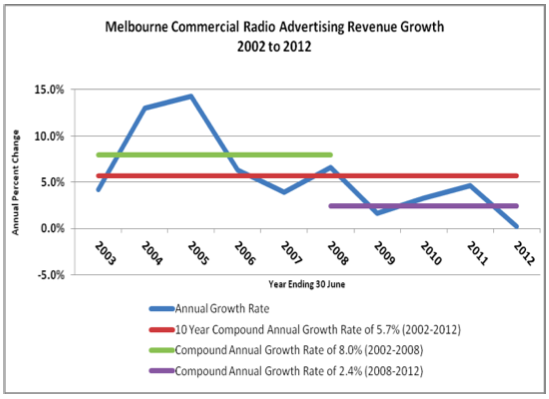

Below Trend Growth in 2012

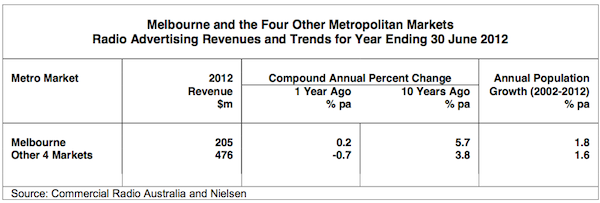

As with the other four metro markets, Melbourne’s 0.2% increase in radio ad revenues in FY 2012 was well below the 5.7% CAGR which was experienced in that city over the past decade between FY 2002 and FY 2012.

And also as in the other metro markets, the Global Financial Crisis (GFC) in 2008 had a noticeable adverse impact on Melbourne radio advertising revenues, leading to a decade of two distinct parts.

After having grown at a strong 8.0% CAGR between FY 2002 and FY 2008, Melbourne radio ad revenues, post the GFC, slowed to an average 2.4% pa rate between FY 2008 to FY 2012.

Melbourne’s Above-Average Ad Revenue Growth Performance

During FY 2012, only Melbourne and Adelaide (+3.4%) managed to increase their radio ad revenues, while declines were experienced in Sydney (-2.1%); Perth (-0.9%) and Brisbane (-0.3%). As a group, the four metro markets other than Melbourne experienced a 0.7% drop in radio ad revenues last year.

Melbourne’s relatively high 5.7% CAGR in radio advertising revenues over the past decade was not far behind that of Brisbane (6.2%) and Perth (7.8%), those being the other two above average metro radio revenue performers during that period. As a group, the other four metro markets had a 3.8% CAGR between 2002 and 2012.

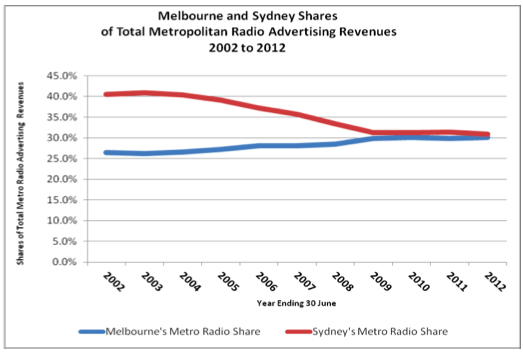

Melbourne’s Rising Metro Radio Ad Revenue Share

With the benefit of above average annual growth in radio ad revenues over the past decade, Melbourne managed to increase its share of total metro radio ad revenues from 26.4% in FY 2002 to 30.1% in 2012, not far below Sydney’s 30.8% share, and bringing it much more into line with its current 31.7% share of the total metro population.

As noted above, if future radio ad revenue growth in Melbourne were to exceed that of Sydney by about 2.8 percentage points for one more year, then its share of total metro radio ad revenues would surpass that of New South Wales’ capital city.

Over the past decade between 2002 and 2012, annual radio ad revenue growth in Melbourne surpassed that of Sydney in all but two years.

This reflected both Melbourne’s relatively low 26.4% radio ad revenue share at the start of the decade in 2002, which was well below its 31.2% metro population share at that same time; combined with a much higher annual population growth rate relative to Sydney (1.8% pa versus 1.1% pa) over the past ten years.

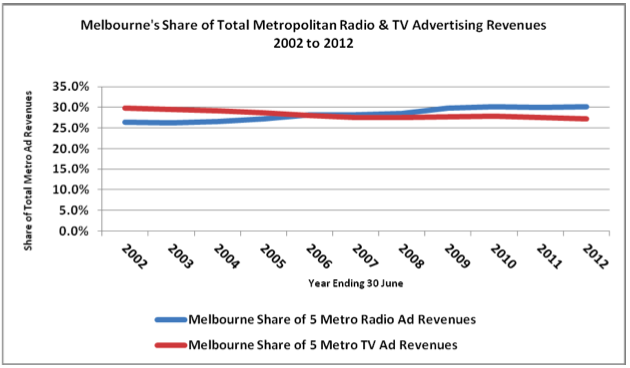

Curiously, at the same time that its share of total metro radio advertising revenues was rising, Melbourne’s share of total metro television advertising revenues has declined fairly steadily from 29.5% in 2002 down to 27.2% by 2012, which is significantly below its current share of the total metropolitan population.

Melbourne’s declining share of metro tv ad revenues over the past decade was a function of that city’s metro tv ad revenues having a low 2.3% CAGR over the past decade when compound annual growth in the other four metro markets in aggregate was higher at 3.7%.

This is the third in a six part series of reports by Bob Peters in which he examines trends in metropolitan radio advertising revenues over the past decade.

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Prior to establishing GMA in early 2001, Bob was a Director of Corporate Finance with ANZ Investment Bank and prior to that Capel Court Investment Bank.

In both his current and previous positions, Bob provides advice to corporate clients in relation to: takeovers & mergers; asset acquisitions & disposals; debt and equity fund-raisings; financial planning & restructuring; business & asset valuations; financial & economic feasibility studies; and the formulation of business strategies.

Bob holds a Bachelor in Economics degree from the Wharton School of Finance & Commerce at the University of Pennsylvania; a Master of Business Administration from The City University in London; and a Master of Economics degree from LaTrobe University in Melbourne.