Despite a challenging media environment, metropolitan radio appears to have delivered a reasonable financial performance in the year ending 30 June 2012 according to Bob Peters’ analysis of the past year’s Metro Radio 2012 financial results, in another of his special reports for radioinfo.

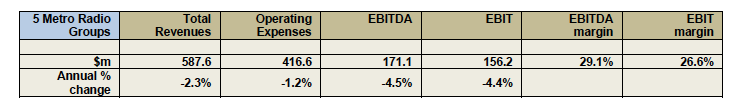

During that period, metro radio’s total revenues declined by about 2% while earnings fell about twice that rate leading to slightly reduced, but still very impressive profit margins of 29% for earnings before interest tax and depreciation (EBITDA) and almost 27% for earnings before interest and tax (EBIT).

These were the principal conclusions of a reporting season review undertaken by Global Media Analysis (GMA) which examined the financial performance of the metro radio operations of five listed public media companies: Southern Cross Austereo (Austereo); APN News & Media (the Australian Radio Network); Fairfax Media (Fairfax Radio); Macquarie Radio Network; and Pacific Star Network.

With the notable exception of DMG Radio Australia, a private company which does not publicly report its financial results, the five companies examined by GMA account for the bulk of metro commercial radio station numbers, revenues and profits.

The aggregated financial performance of the five metro radio groups over the 12 months to June 2012 was as follows:

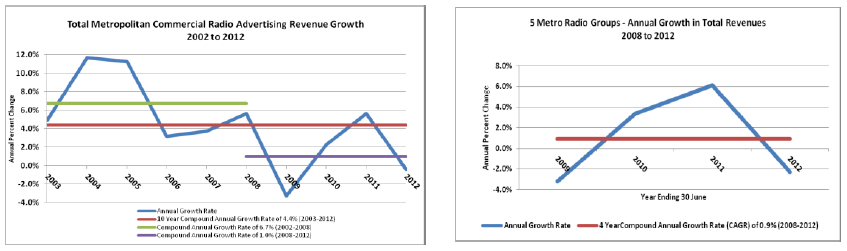

As with total metro radio advertising revenues which in aggregate declined by 0.5% the year ending 30 June 2012, growth in total revenues for the five metro radio groups over the past five years has been both volatile and below longer term trend rates, in the wake of the Global Financial Crisis of late 2008.

After falling by 3.2% in 2009, total revenues of the five metro radio groups increased by 3.4% in 2010 and 6.1% in 2011, before declining by 2.3% during the year ending June 2012.

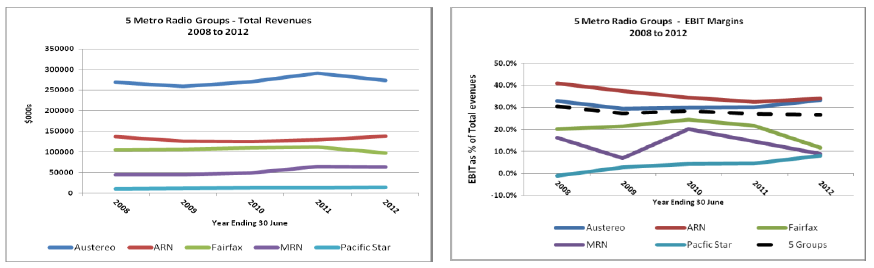

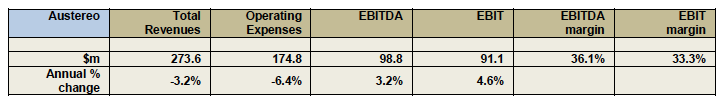

Austereo remained the largest metro commercial radio group, with revenues, operating expenses and earnings which were almost twice as large as those of the Australian Radio Network (ARN), the next largest group, but ARN retained the title of being the metro radio group with the industry’s highest profit margins.

Although its advertising revenues and underlying total revenues declined by 4.7% and 3.2% respectively, a 6.4% reduction in operating costs enabled Austereo to increase EBITDA by 3.2% and EBIT by 4.6% and to improve its EBITDA and EBIT margins to 36.1% and 33.3% respectively in fiscal year (FY) 2012.

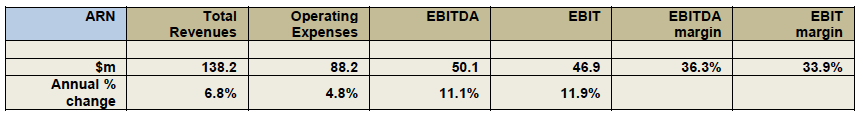

ARN produced a solid financial result in the 12 months ending June 2012 on the back of ratings improvements in some key markets and demographics. Total revenues out-performed the total metro market and increased by 6.8%, while operating expenses growth was limited only 4.8%. Consequently EBITDA and EBIT increased by 11.1% and 11.9% respectively leading yet again to industry-high EBITDA and EBIT margins of 36.3% and 33.9%

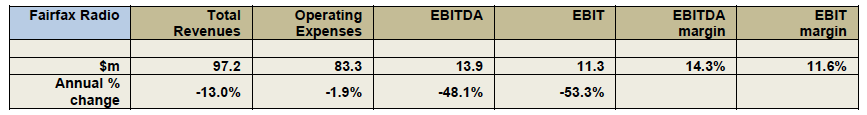

A now-terminated sale process combined with management changes and the sale of its regional radio operations, contributed to a 13.0% reduction in total revenues, a halving of earnings and a sizeable reduction in EBITDA and EBIT margins for Fairfax Radio in FY 2012.

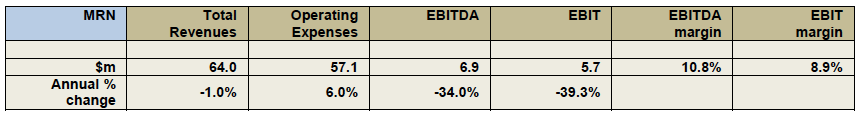

Costs associated with the operation and eventual closure of the unsuccessful Melbourne Talk Radio joint venture with Pacific Star exacerbated a modest downturn at MRN’s 2GB/2CH Sydney duopoly. Total revenues, which include revenues at MTR, were down by 1.0% but EBITDA and EBIT fell by 34.0% and 39.3% respectively in FY 2012.

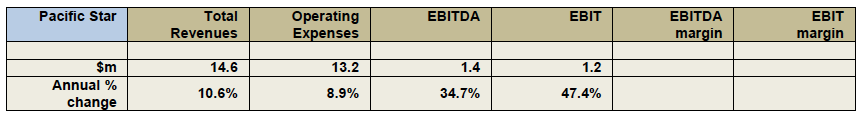

Good revenue and profit growth at Pacific Star’s core Melbourne station 1116SEN under-pinned a strong group result with total revenues growing by 10.6% and EDITDA and EBIT increasing by 34.7% and 47.4% respectively in FY 2012.

This is the next in a six part series of reports by Bob Peters in which he examines trends in metropolitan radio advertising revenues over the past decade.�

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Bob Peters is a Director of Global Media Analysis Pty Ltd (“GMA”), a specialist financial and strategic consultancy to the media, entertainment, telecommunications and technology industries. Bob is also recognised as one of Australia’s leading media industry analysts.

Prior to establishing GMA in early 2001, Bob was a Director of Corporate Finance with ANZ Investment Bank and prior to that Capel Court Investment Bank.

In both his current and previous positions, Bob provides advice to corporate clients in relation to: takeovers & mergers; asset acquisitions & disposals; debt and equity fund-raisings; financial planning & restructuring; business & asset valuations; financial & economic feasibility studies; and the formulation of business strategies.

Bob holds a Bachelor in Economics degree from the Wharton School of Finance & Commerce at the University of Pennsylvania; a Master of Business Administration from The City University in London; and a Master of Economics degree from LaTrobe University in Melbourne.