SCA CEO Grant Blackley speaks to radioinfo about the highlights of the past six months and the company’s radio strategy for 2018.

While the top line statutory results report a drop in profit from $48 to $38 million (a 22% decrease, see our other report), the company’s balance sheet is in far healthier shape now than it was last year. The company has reduced its debt and has also reduced costs by selling its regional transmitters and refinancing its debt structure at a more favourable interest rate.

After selling off its regional transmitters, the company also reduced technical staffing, making a small number of staff, including National Radio Engineering Manager Steve Adler redundant. “We continue to keep a tight control on costs where opportunities arise,” Blackley told radioinfo.

He also explained two extraordinary items in the expenses this half year, which were beneficial for the company’s bottom line. SCA, like other radio companies benefitted from the government’s licence fee rebate and also was able to return some provisions to the bottom line which it was saving to fight the PPCA copyright dispute. “We had put aside some reserves for our share of the legal costs relating to the PPCA dispute with the radio industry. That has now been settled, so we no longer need to show those reserves on our books,” Blackley said.

Network Branding

Network Branding

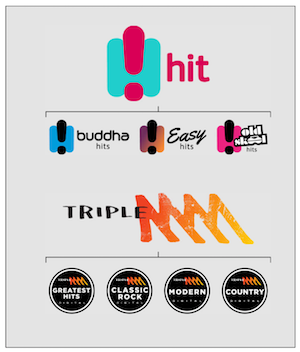

The big headline for SCA’s Radio Division has been the rebranding of all stations to align them to either the Triple M or Hit brands.

All the company’s regional stations are now aligned with Triple M or Hit for branding and selling purposes, as are the company’s seven digital radio stations.

Regional Radio

“The agency reaction to the change has been wonderful… We have made regional radio more accessible, easier to understand and to buy, we have also increased the number of regional surveys, giving agencies more data points for their clients.

“SCA has also paid to integrate regional ratings data with agency systems, making it easier for them track and buy regional inventory… this has certainly helped us, because our regional radio revenue is up, and we think it has probably helped all regional radio groups, not just our stations,” Blackley told radioinfo.

National Drive Shows

With plenty of time to plan for the loss of Hamish and Andy’s national Hit Network drive show, SCA’s strategy was to introduce two national drive shows. This is now in place, with former KIIS network drive duo Hughesy and Kate moving over to the Hit Network this year and the Kennedy Molloy drive show introduced on the Triple M network.

“We are absolutely delighted with both of the new drive formats. There has been a seamless transition and revenue is already up for these national drive shows,” according to Blackley.

Blackley would not be drawn on whether Kate Langbroek was only signed up for a year, when we put to him Duncan Campbell’s comments about Langbroek wanting to take a long period of leave to travel overseas with her family (see our report from last year).

“Yes, I read that on radioinfo… Duncan should stick to his knitting… I won’t comment on that, all I can say is that Kate tells me she is very very happy working with us,” he said.

2Day FM

Blackley has put on record that the company is focusing on improving the ratings results for 2Day FM in Sydney, but it is not just about the breakfast show.

“As you know, improving ratings is not just about one thing, it is about having an overall station strategy, so we have made changes to the breakfast show, bringing on Grant Denyer and Ed Kavalee, but this is only one part of a four part strategy.”

The bigger picture strategy for 2Day involves changing the music, the new drive show, and finding a new niche for the station in the Sydney market.

“We think we have found some clean air. We have moved our music a little older and we are targeting slightly older listeners with Hughesy and Kate, so we are moving the target median age of our listeners slightly older. The core target demographic is still females 25-54, but Blackley anticipates moving the station to the slightly older end of that spectrum to gather more mums with young families than the competitors Nova and KIIS.

“We are moving a little older than the other two stations, but not heading into the WSFM or Smooth territory, we think we have found clear air in between both lots of competitors… it is part of our bigger picture strategy” he said.

Digital Radio

With metro digital radio ratings set to be released on the same day as AM/FM ratings from survey one this year, Blackley and the radio executive team have also figured that into the network strategy. He expects that the simultaneous release of these figures will also give SCA an advantage in sales now that all the networks have consistent branding.

DAB+ stations have been surveyed for four years now and the market segment is now mature, so we are happy that the results will all come out on the same survey day from now on.

DAB+ and catch up replay offerings will be sold as part of SCA’s radio offerings.

Podcasting

Blackley sees DAB+ and catch-up radio as one part of his company’s strategy, but sees Podcast One as a very separate business strategy.

“Podcasting is a new market segment, it is more like Netflix than catch up radio.

“Our strategy is about developing new products on this platform and offering them to the market to see who will pay for them and what the new business models will be. We are happy to be an early adopter in this space to see where the market goes… we think there is strong potential for organic growth, we will be developing new Australian content on this platform and offering Podcast One as premium content.”

Blackley has a strong, big-picture strategy for SCA’s radio business in 2018, that should position the company strongly for the year ahead.

View the full results presentation here.