A study of American audio consumption by music streaming service Pandora has, not unexpectedly, talked up the growth of music streaming and podcasting, but has also acknowledged that traditional analog broadcast radio is still strong, but is “finding a new place in the audio landscape.”

In Australia, where the radio industry is stronger than in America, Pandora recently closed down its local operations and disabled its mobile app.

The report says:

Radio has prospered for so many decades because it’s free, easy to use, and there are tons of devices around. Until recently, it was the only way to enjoy music without having to invest in a record collection, or to hear news, sports and traffic information while on the go.

But AM/FM faces serious competition from personalized, digital alternatives. Waze and Google Maps, for example, offer real-time traffic updates on individual routes; listeners can choose the play-by-play team of their choice, even if it’s out-of-market; and Pandora leads the way in serving music that’s personalized for each listener.

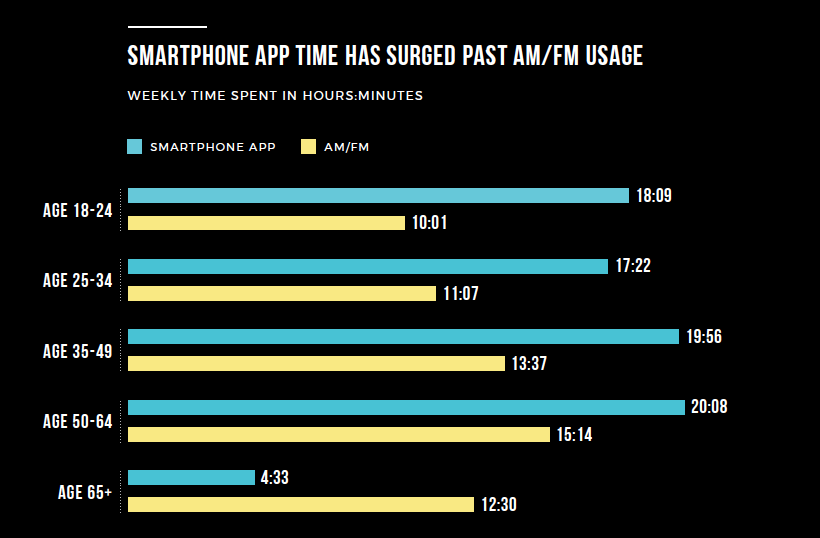

As much as the radio industry loves to promote its wide reach, another critical metric, time spent listening, has been riding a steady decline. Daily time spent

listening to AM/FM has fallen by 34% between 2007 and 2017.3, 20 Clearly, listeners are not using AM/FM for as long or as often as they did before. Time spent listening to AM/FM will continue to fall as consumers take advantage of unlimited mobile data plans, acquire more digital media devices in homes and cars, and as radio’s most loyal demographic, Americans aged 50+, embrace the digital revolution. Persons aged 50-64 who have mobile devices are, for the first time in the past year, spending more time with mobile apps than they are listening to AM/FM radio.

The report goes on to say that streaming audio has become the “shining example of personalized digital media that couldn’t be offered in an older era.”

Happy listeners make for happy advertisers. Streaming is a terrific ad platform, thanks to superior targeting, a better user experience, and a higher level of

accountability. Streaming ads can be targeted to listeners engaged in specific activities, such as commuting, working out, or preparing for bed. Different versions of the same ad, such as an announcer’s gender, can be served to specified listeners. Post-campaign research can tie lift metrics to actual

exposure frequencies. Americans’ growing love affair with smartphones is largely responsible for streaming’s growth.

The most interesting connected technologies are happening in the home. Almost everything with a plug these days, not to mention the plugs themselves,

are being made to connect to a home network.

A fast-growing source of streaming listening is happening on the millions of smart TVs, over-the-top (OTT) media boxes such as Roku and Apple TV, and

whole-home audio systems such as Sonos. The sexy new audio entrants are smart speakers from Amazon and Google.

Today, hundreds of thousands of podcasts address every imaginable topic: At least 15 podcasts will satisfy your Game of Thrones appetite; fans of the NBA

champion Golden State Warriors can hear at least eight different podcasts that follow the team throughout the year. The New York Times and National Public

Radio each put out national news podcasts at 6 a.m. every morning, and you can find countless other podcasts discussing everything from expectant parenthood to golfing techniques.

Other key points from the report are:

- Although broadcast radio is the dominant medium in the car, drivers of the newest cars on the road use 40% less AM/FM than drivers of the oldest cars.

- The time that people spend with mobile apps surged in the last year, particularly among people aged 50-64, which happens to also be radio’s most engaged demographic. Remarkably, this group now spends more time with their mobile apps than any other age group–even more time than they do with AM/FM radio.

- In the last year, voice technology has become nearly as accurate as human hearing, evidenced by the rapid (and still growing) adoption of in-home smart speakers like the Amazon Echo and Google Home. The path is paved for a revolution in how we interact with our devices and how marketers will reach consumers without a screen.

- AM/FM broadcast ad revenues are projected to decline by 4.7% annually through 2022, decreasing from $13.5 billion this year to $10.6 billion.

- Podcasts earned $220 million in ad revenues in 2017 but there’s still plenty of upside, particularly if advertisers can obtain more listening metrics.

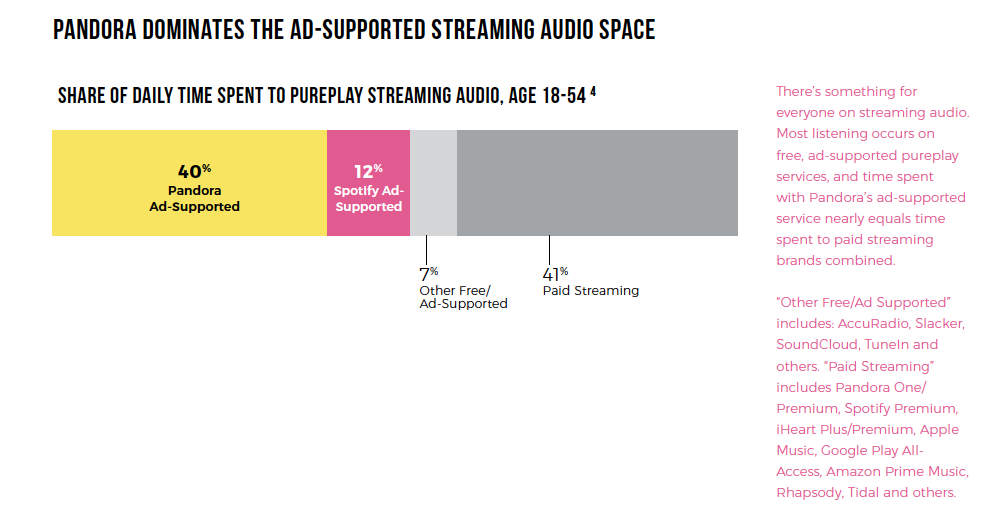

The report says Pandora “dominates” the ad supported streaming audio space.