Macquarie Radio Network’s revenue declined 4% to $52.6 million in the past financial year. Profit down 62%.

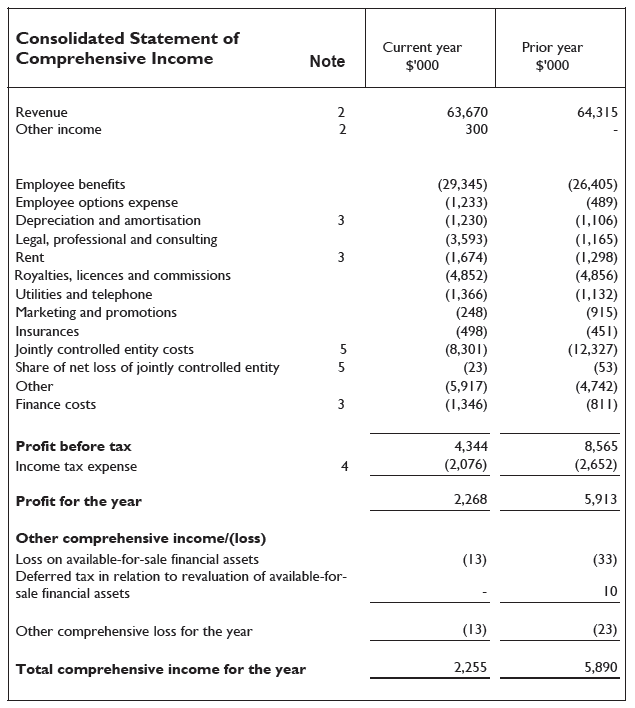

The company made a reported profit of $2.3 million, down 62% on last financial year in a ‘soft’ market, according to its annual figures lodged with the Stock Exchange. But there is more to the story when you look more deeply into the figures.

The overall profit (NPAT) number is a requirement for stock exchange reporting, but a more meaningful long term figure for the company is its ‘underlying revenue’ which removes the costs of its failed 3MTR venture in Melbourne ($5.5 million), the cost of acquiring Brad Smart’s regional radio network, and the negligable costs of its unsuccessful bid for Fairfax Radio.

Once these abnormals are removed from the balance sheet, underlying profit is a more healthy $8.8 million, although this is still 18% down on last year.

From the MRN financial figures the cost of acquiring Smart Radio Network is now known to be $1.3 million.

MRN’s share of Sydney radio revenue declined slightly, but is still a very healthy 25% of the Sydney market. According to those figures, one quarter of advertising money in Sydney is spent with 2GB.

A fully franked final dividend of 1.5 cents per share was declared, with full year dividends being 4 cents per share, half of the full year dividend paid last year.

Executive Chairman Russell Tate said the result was “satisfactory given the softness of the Sydney radio market… and the underperforming Melbourne venture.”

Looking ahead, Tate was not optimistic: “Forward bookings are about as short as we have seen them and are unlikely to reach prior year levels.” He is hoping for earnings (EBITDA) of around $15 million if conditions improve.