Southern Cross Austereo has announced underlying net profit after tax of $100 million for the full year to 30 June 2012. Overall revenue down by 3.9%, metro revenue down, regional radio revenue up.

Chief Executive Officer Rhys Holleran along with the Chief Financial Operator Stephen Kelly revealed the company’s financial health and outlook this morning at Southern Cross Austereo’s Sydney headquarters at World Square, saying, despite radio products performing strongly, television financial numbers seem to be a worry.

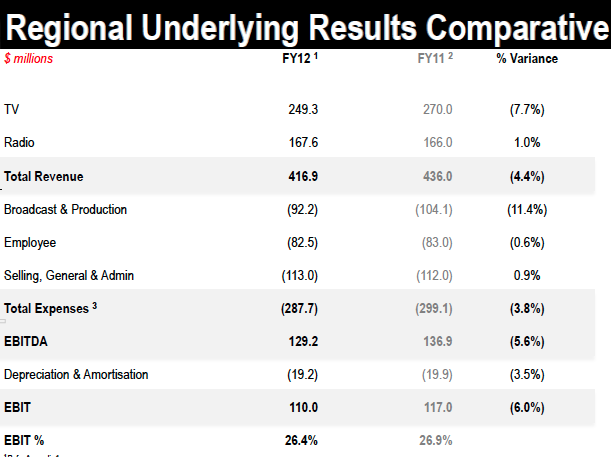

In the full year results SCA’s television business has declined by 2% compared to last year. This year’s results are a better representation of the company as an integrated multimedia player, because the regional and metropolitan branches of the business have now been aligned, whereas last year’s results reflected the business in its transitionary phase.

RADIO

The regional radio division of Southern Cross grew by 3.1% from last year on the back of solid national sales.

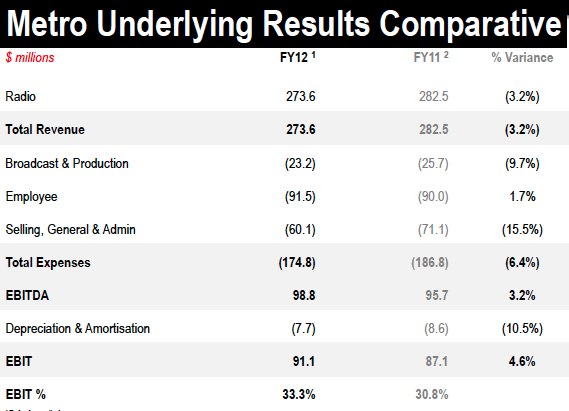

Metropolitan radio revenue declined 4.7% in what is already a negative market and some issues to do with the Hamish and Andy brand.

The loss of Hamish and Andy’s daily show hit national revenue, with Holleran telling analysts that the repositioning of the Hamish and Andy show, dropping from a daily show to once a week contributed to a decline in some national advertising accounts.

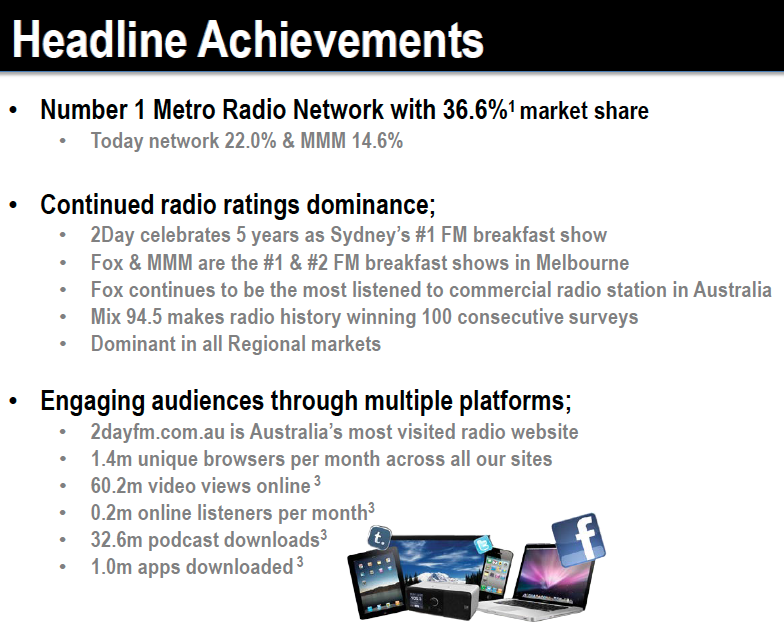

“The revenue decline is particularly related to a ratings decline in the drive time shift and some local issues around the 2Day FM brand, but it’s important to note that despite this, we still command 36% of the market,” he said.

Holleran was pleased that the company’s national footprint of radio and tv coverage has already realised ‘All Australia Buys.’ This was illustrated by the dramatic 13% growth of national advertising in regional markets. He says economic conditions in the bush are still ‘subdued.’

Local and national advertising are a mirror image of each other in the city and the bush:

- Regional radio’s local advertising is 64% of revenue and national advertising is 27%.

- In Metro markets, local advertising is 27% of revenue and national advertising is 64%.

OVERALL

The decline in TV revenue was attributed to poor ratings and a negative tv advertising market.

The company broke out metro and regional figures in its accounts, shown below in comparison to last year.

Outlining overall performance of the company, Holleran said: “The performance of the Group in its first full year as a truly integrated business has been commendable in a difficult market. We have managed to improve margins despite a 3.9% reduction in revenues and met the commitment we made to shareholders when we acquired the Austereo Group by delivering an underlying net profit after tax of $100.1 million.

“The energy and commitment our staff have shown in embracing our vision of becoming a national multi-platform media network has driven much of this success, and positions us well for the challenges that lay ahead in a difficult advertising market.”

In keeping with the company’s stated capital management strategy, SCMG Chairman, Max Moore-Wilton, announced a final fully franked dividend of 5 cents per share taking the full year dividend to 10 cents per share fully franked on reported earnings of 13.5 cents per share, a 74% payout ratio.

Other business topics talked about this morning at World Square included Kyle Sandilands’ ongoing impacts on advertisers and the future direction of the company, especially Guy Dobson’s new role as the Chief Content Officer and how that aligns with SCA’s objectives and aims to remain a forward thinking content company first and foremost.

Number crunching (full year to 30 June 2012)

- $100.1M Underlying or Core net profit after tax

- EBITDA Margin expansion by 0.7% to 33%

- Net debt reduced by $71.6M to $621.8M resulting in a leverage ratio of 2.62

- 3.9% reduction in revenues

- Fully franked dividend of 5 cents per share taking the full year dividend to 10 cents per share fully franked on reporting earnings of 13.5 cents per share, a 74% payout ratio.