Job cuts to ad-free music subscription service Rdio appear to be drastic and go to the viability of the company.

TechCrunch has reported that around 35 people have been fired, which constitues between 1/5 and 1/3 of the company’s small workforce according to its estimates.

In a response to a question on how the company is doing, Rdio provided TechCrunch with the following statement:

“We are not releasing any numbers at the moment, but we’re thrilled with the traction we’ve seen so far. Since the end of last year (2012) we’ve tripled our number of new users. Also, 90% of our subscribers are now on the Rdio Unlimited tier ($9.99/month) giving them access to Rdio not just on the Web but also through their mobile phone. Our strategic partnerships, and integrations with Facebook, Twitter, and Shazam have all contributed to our continued growth and we’re excited about what’s to come for Rdio in the future.”

In a field that has grown impressively over the past few years, and is currently dominated by heavy-weight Spotify, it is unclear whether more general conclusions about the future of subscription music streaming can be drawn from these lay-offs. Spotify itself continues to struggle with music-licensing fees, meaning that its finances are in the red: even in 2012 when its revenue doubled, it failed to make a profit. Around 70% of its revenue goes to paying royalties, of which it has paid around $500 million. Rdio and other like services have faced the same problem.

Nonetheless, Spotify has more than five million paying subscribers, proving that customers will be happy to pay rather than pirate if there is a very rich library of music on offer (so long as it’s inexpensive and available everywhere). Conversely, there are eighteen million users of Spotify who choose not to pay and instead stomach the ads. A positive step is that Google has recently started its own All Access music subscription service. The possible entry of Google into the market would potentially give streaming companies more leverage to negotiate royalties with record labels and government regulators.

If high costs continue it is possible that the field will eventually be dominated by mega companies that can afford to cross-subsidise music streaming, making a loss on the music streaming aspect of their business in order to attract listeners into their other products. For instance, Apple (which doesn’t offer a subscription music service per se, but is nonetheless a good example) sold music on their Itunes store approximately at the price they purchased it for in order to entice consumers into digital music and consequently into iPods and similar hardware products.

Similarly, Google, Amazon and Microsoft sell music in order to attract listeners into their mobile products, online store, and hardware.

For companies like Spotify, Deezer and Rdio, that do not of the benefit of viable cross-subsidisation, their future is not as clear.

A spokesperson for Rdio issued a very short statement: “Rdio confirmed making across-the-board workforce reductions today to improve its cost structure and ensure a scalable business model for the long-term.”

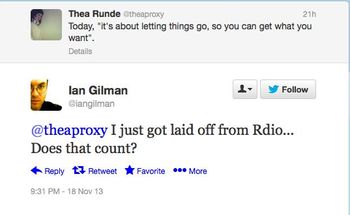

Here are some tweets from disgruntled Rdio ex-employees: